Summary

In economic and financial networks, the strength of each node has always an important economic meaning, such as the size of supply and demand, import and export, or financial exposure. Constructing null models of networks matching the observed strengths of all nodes is crucial in order to either detect interesting deviations of an empirical network from economically meaningful benchmarks or reconstruct the most likely structure of an economic network when the latter is unknown. However, several studies have proved that real economic networks and multiplexes are topologically very different from configurations inferred only from node strengths. Here we provide a detailed analysis of the World Trade Multiplex by comparing it to an enhanced null model that simultaneously reproduces the strength and the degree of each node. We study several temporal snapshots and almost one hundred layers (commodity classes) of the multiplex and find that the observed properties are systematically well reproduced by our model. Our formalism allows us to introduce the (static) concept of extensive and intensive bias, defined as a measurable tendency of the network to prefer either the formation of extra links or the reinforcement of link weights, with respect to a reference case where only strengths are enforced. Our findings complement the existing economic literature on (dynamic) intensive and extensive trade margins. More in general, they show that real-world multiplexes can be strongly shaped by layer-specific local constraints.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

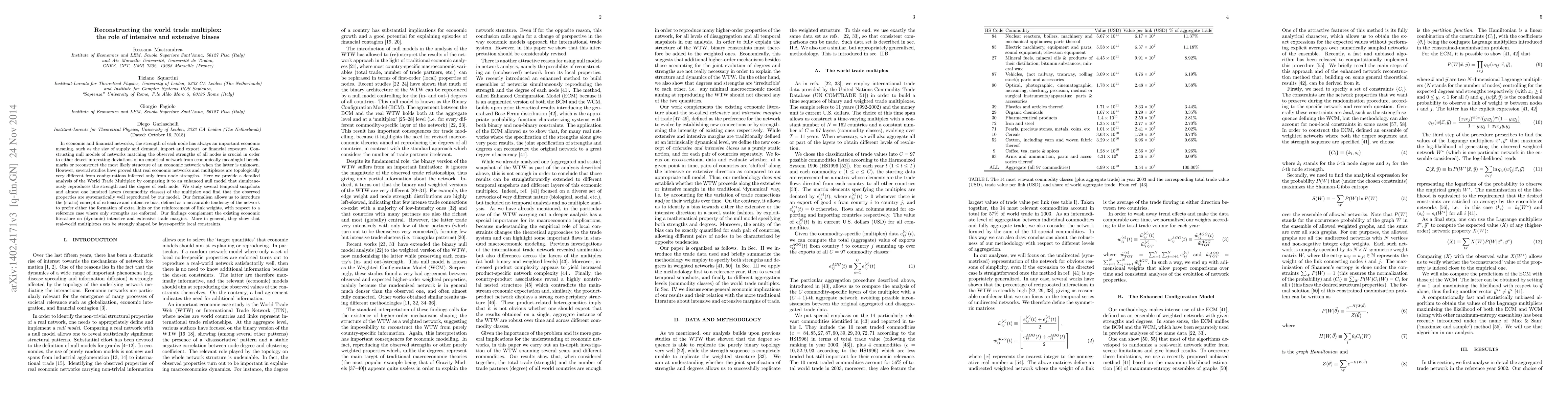

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpanning trees of the World Trade Web: real-world data and the gravity model of trade

Agata Fronczak, Piotr Fronczak, Patryk Skowron et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)