Authors

Summary

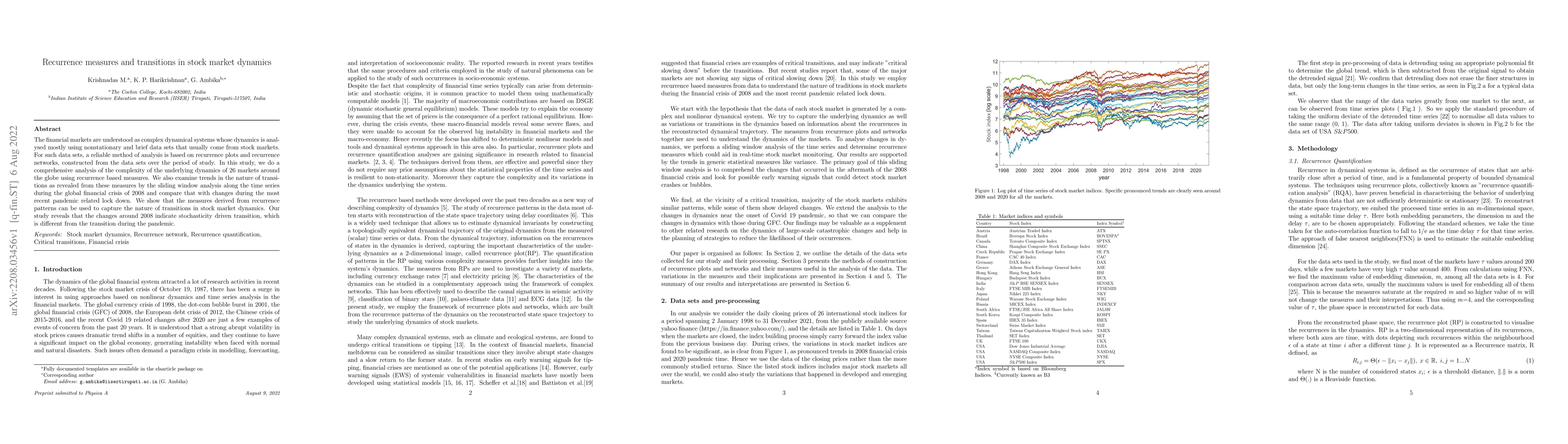

The financial markets are understood as complex dynamical systems whose dynamics is analysed mostly using nonstationary and brief data sets that usually come from stock markets. For such data sets, a reliable method of analysis is based on recurrence plots and recurrence networks, constructed from the data sets over the period of study. In this study, we do a comprehensive analysis of the complexity of the underlying dynamics of 26 markets around the globe using recurrence based measures. We also examine trends in the nature of transitions as revealed from these measures by the sliding window analysis along the time series during the global financial crisis of 2008 and compare that with changes during the most recent pandemic related lock down. We show that the measures derived from recurrence patterns can be used to capture the nature of transitions in stock market dynamics. Our study reveals that the changes around 2008 indicate stochasticity driven transition, which is different from the transition during the pandemic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)