Summary

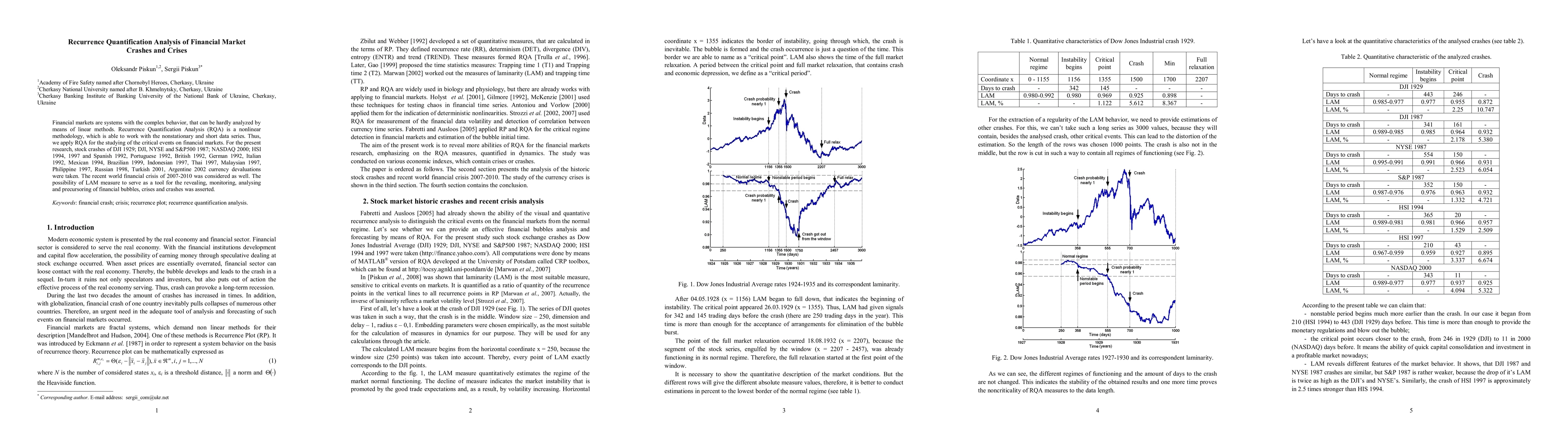

Financial markets are systems with the complex behavior, that can be hardly analyzed by means of linear methods. Recurrence Quantification Analysis (RQA) is a nonlinear methodology, which is able to work with the nonstationary and short data series. Thus, we apply RQA for the studying of the critical events on financial markets. For the present research, stock crashes of DJI 1929; DJI, NYSE and S&P500 1987; NASDAQ 2000; HSI 1994, 1997 and Spanish 1992, Portuguese 1992, British 1992, German 1992, Italian 1992, Mexican 1994, Brazilian 1999, Indonesian 1997, Thai 1997, Malaysian 1997, Philippine 1997, Russian 1998, Turkish 2001, Argentine 2002 currency devaluations were taken. The recent world financial crisis of 2007-2010 was considered as well. The possibility of LAM measure to serve as a tool for the revealing, monitoring, analysing and precursoring of financial bubbles, crises and crashes was asserted.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)