Summary

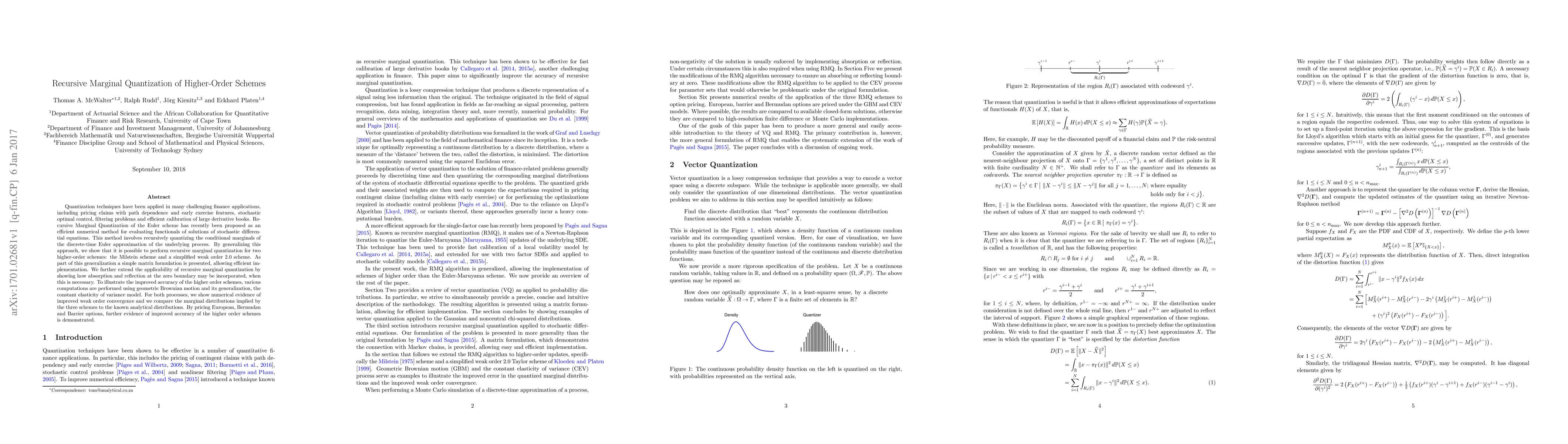

Quantization techniques have been applied in many challenging finance applications, including pricing claims with path dependence and early exercise features, stochastic optimal control, filtering problems and efficient calibration of large derivative books. Recursive Marginal Quantization of the Euler scheme has recently been proposed as an efficient numerical method for evaluating functionals of solutions of stochastic differential equations. This method involves recursively quantizing the conditional marginals of the discrete-time Euler approximation of the underlying process. By generalizing this approach, we show that it is possible to perform recursive marginal quantization for two higher-order schemes: the Milstein scheme and a simplified weak order 2.0 scheme. As part of this generalization a simple matrix formulation is presented, allowing efficient implementation. We further extend the applicability of recursive marginal quantization by showing how absorption and reflection at the zero boundary may be incorporated, when this is necessary. To illustrate the improved accuracy of the higher order schemes, various computations are performed using geometric Brownian motion and its generalization, the constant elasticity of variance model. For both processes, we show numerical evidence of improved weak order convergence and we compare the marginal distributions implied by the three schemes to the known analytical distributions. By pricing European, Bermudan and Barrier options, further evidence of improved accuracy of the higher order schemes is demonstrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)