Summary

This paper concerns the recursive utility maximization problem under partial information. We first transform our problem under partial information into the one under full information. When the generator of the recursive utility is concave, we adopt the variational formulation of the recursive utility which leads to a stochastic game problem and a characterization of the saddle point of the game is obtained. Then, we study the K-ignorance case and explicit saddle points of several examples are obtained. At last, when the generator of the recursive utility is smooth, we employ the terminal perturbation method to characterize the optimal terminal wealth.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper transforms the recursive utility maximization problem under partial information into a full information problem, using variational formulation for concave generators and terminal perturbation method for non-concave generators.

Key Results

- Characterization of saddle points for the stochastic game problem when the generator is concave.

- Explicit saddle points for K-ignorance cases.

- Characterization of optimal terminal wealth using terminal perturbation method for non-concave generators.

Significance

This research contributes to the understanding of optimal investment strategies under partial information, which is crucial for financial modeling and decision-making in incomplete markets.

Technical Contribution

The paper presents a duality approach for recursive utility maximization under partial information, combining variational methods and terminal perturbation techniques.

Novelty

The integration of variational formulation with terminal perturbation for addressing both concave and non-concave generator cases in recursive utility maximization under partial information.

Limitations

- The methodology is primarily applicable to problems with specific conditions such as concavity or smoothness of the generator.

- The results may not generalize easily to more complex or non-standard utility functions.

Future Work

- Explore extensions of the methodology to handle more general utility functions and market models.

- Investigate the implications of the findings for real-world financial applications.

Paper Details

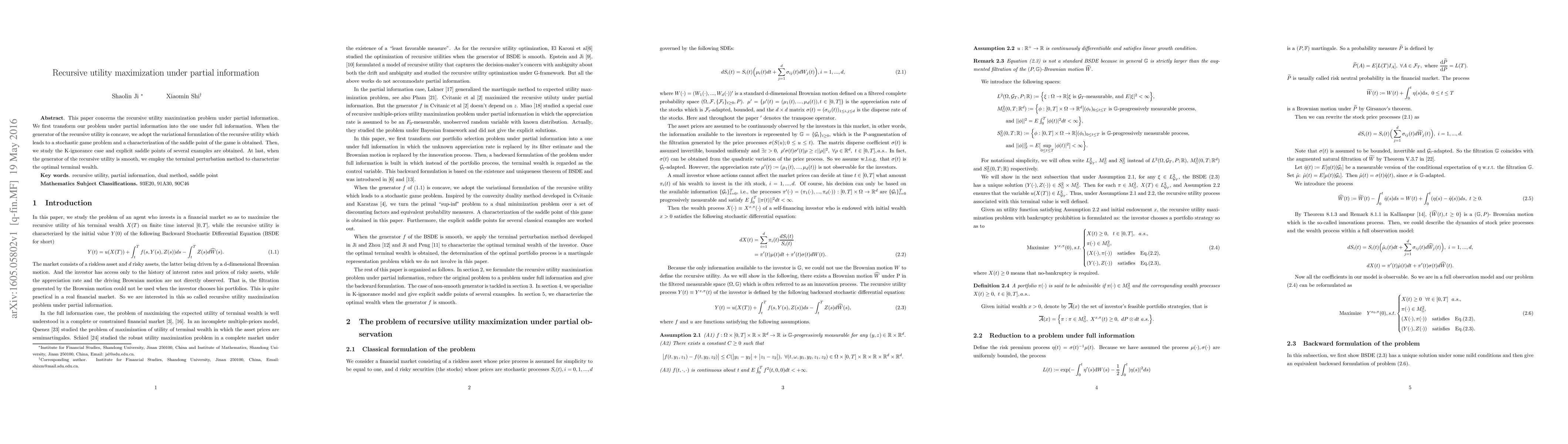

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWell Posedness of Utility Maximization Problems Under Partial Information in a Market with Gaussian Drift

Abdelali Gabih, Ralf Wunderlich, Hakam Kondakji

Towards Sequence Utility Maximization under Utility Occupancy Measure

Philip S. Yu, Wensheng Gan, Gengsen Huang

No citations found for this paper.

Comments (0)