Summary

In this paper we introduce a sublinear conditional operator with respect to a family of possibly nondominated probability measures in presence of multiple ordered default times. In this way we generalize the results of [5], where a reduced-form framework under model uncertainty for a single default time is developed. Moreover, we use this operator for the valuation of credit portfolio derivatives under model uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

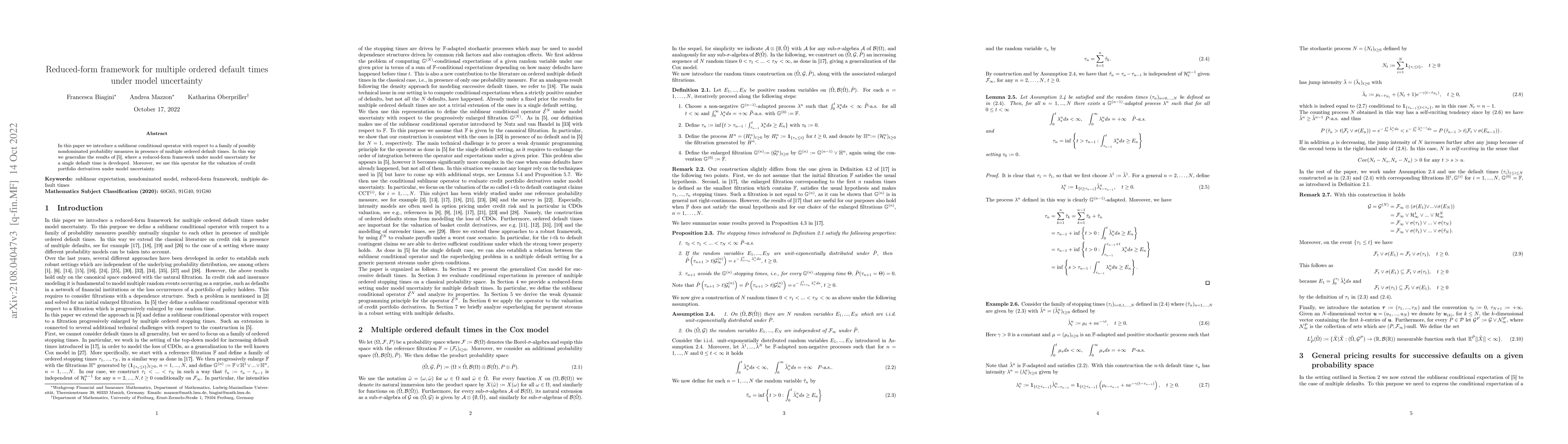

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)