Summary

We start with a stochastic control problem where the control process is of finite variation (possibly with jumps) and acts as integrator both in the state dynamics and in the target functional. Problems of such type arise in the stream of literature on optimal trade execution pioneered by Obizhaeva and Wang (models with finite resilience). We consider a general framework where the price impact and the resilience are stochastic processes. Both are allowed to have diffusive components. First we continuously extend the problem from processes of finite variation to progressively measurable processes. Then we reduce the extended problem to a linear quadratic (LQ) stochastic control problem. Using the well developed theory on LQ problems we describe the solution to the obtained LQ one and trace it back up to the solution to the (extended) initial trade execution problem. Finally, we illustrate our results by several examples. Among other things the examples show the Obizhaeva-Wang model with random (terminal and moving) targets, the necessity to extend the initial trade execution problem to a reasonably large class of progressively measurable processes (even going beyond semimartingales) and the effects of diffusive components in the price impact process and/or in the resilience process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

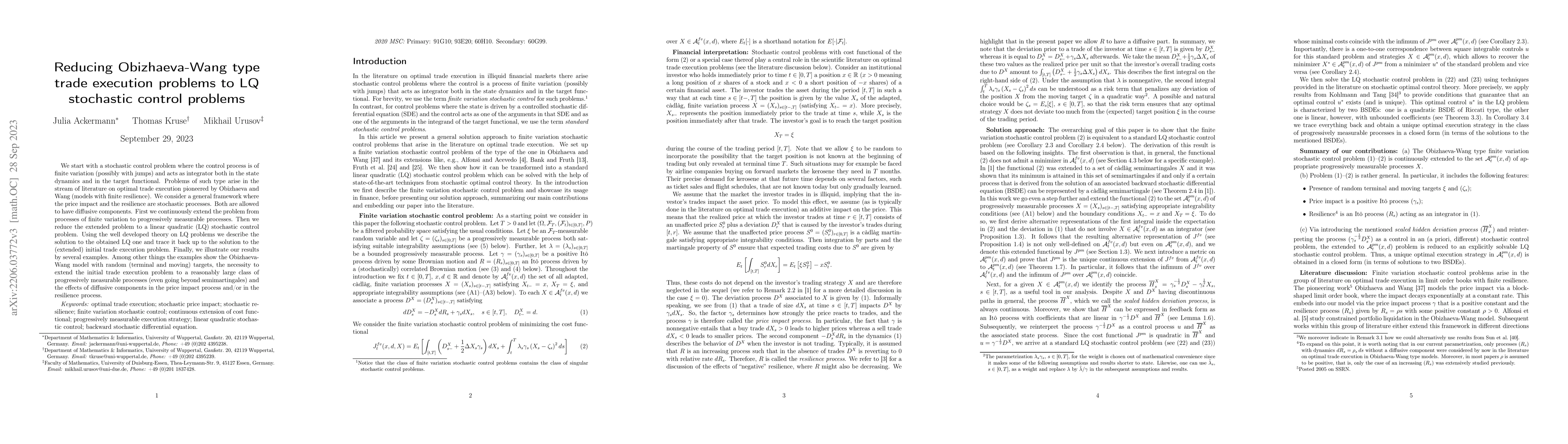

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-asset optimal trade execution with stochastic cross-effects: An Obizhaeva-Wang-type framework

Julia Ackermann, Mikhail Urusov, Thomas Kruse

| Title | Authors | Year | Actions |

|---|

Comments (0)