Summary

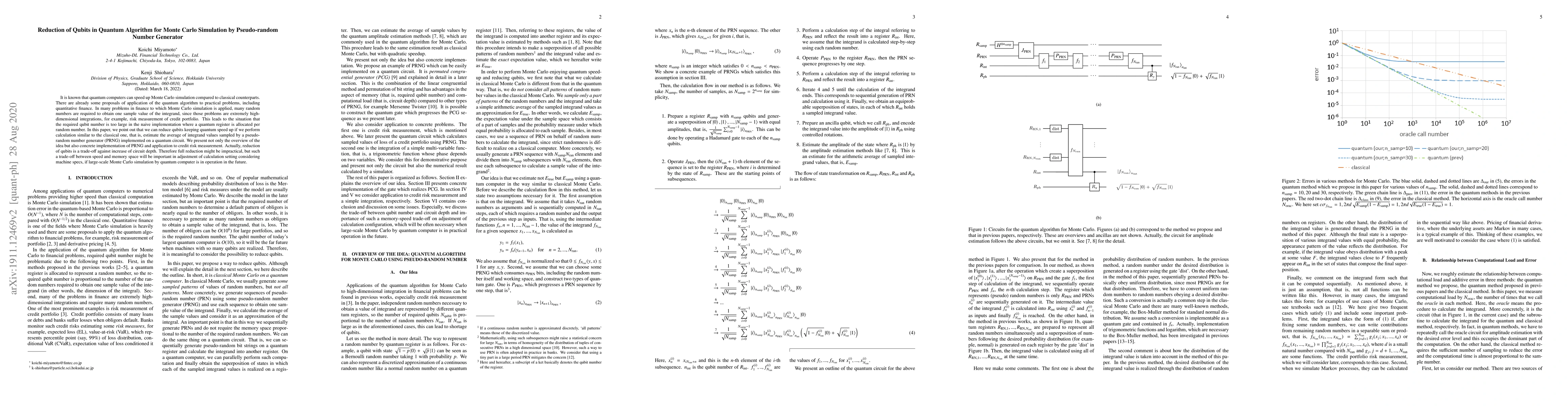

It is known that quantum computers can speed up Monte Carlo simulation compared to classical counterparts. There are already some proposals of application of the quantum algorithm to practical problems, including quantitative finance. In many problems in finance to which Monte Carlo simulation is applied, many random numbers are required to obtain one sample value of the integrand, since those problems are extremely high-dimensional integrations, for example, risk measurement of credit portfolio. This leads to the situation that the required qubit number is too large in the naive implementation where a quantum register is allocated per random number. In this paper, we point out that we can reduce qubits keeping quantum speed up if we perform calculation similar to classical one, that is, estimate the average of integrand values sampled by a pseudo-random number generator (PRNG) implemented on a quantum circuit. We present not only the overview of the idea but also concrete implementation of PRNG and application to credit risk measurement. Actually, reduction of qubits is a trade-off against increase of circuit depth. Therefore full reduction might be impractical, but such a trade-off between speed and memory space will be important in adjustment of calculation setting considering machine specs, if large-scale Monte Carlo simulation by quantum computer is in operation in the future.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPseudo Quantum Random Number Generator with Quantum Permutation Pad

Randy Kuang, Dafu Lou, Alex He et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)