Summary

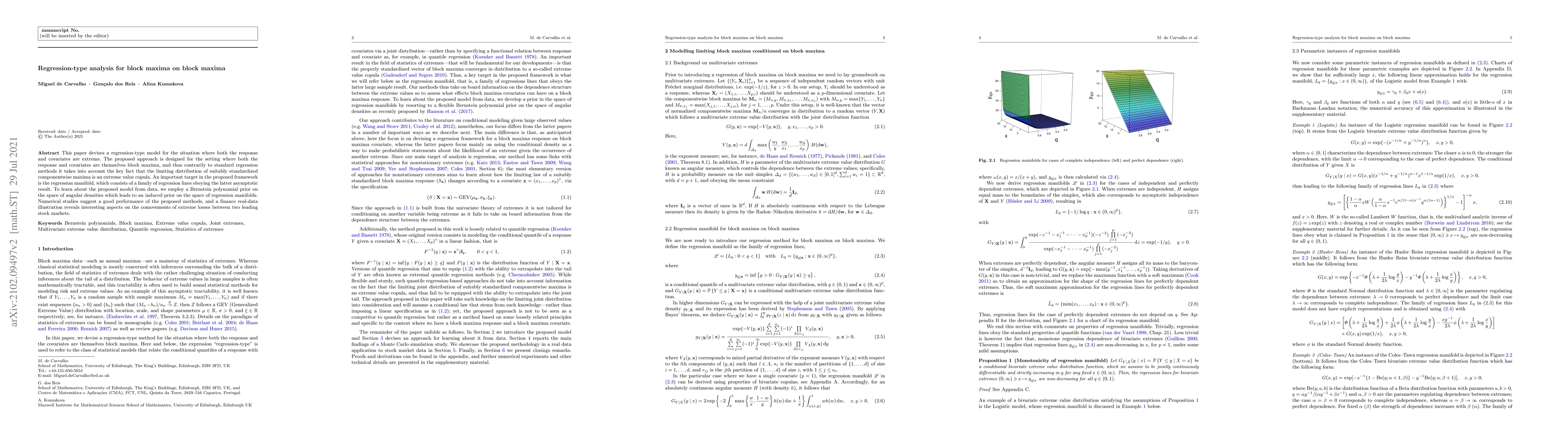

This paper devises a regression-type model for the situation where both the response and covariates are extreme. The proposed approach is designed for the setting where both the response and covariates are themselves block maxima, and thus contrarily to standard regression methods it takes into account the key fact that the limiting distribution of suitably standardized componentwise maxima is an extreme value copula. An important target in the proposed framework is the regression manifold, which consists of a family of regression lines obeying the latter asymptotic result. To learn about the proposed model from data, we employ a Bernstein polynomial prior on the space of angular densities which leads to an induced prior on the space of regression manifolds. Numerical studies suggest a good performance of the proposed methods, and a finance real-data illustration reveals interesting aspects on the comovements of extreme losses between two leading stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBootstrapping Estimators based on the Block Maxima Method

Axel Bücher, Torben Staud

Empirical Bayes inference for the block maxima method

Stefano Rizzelli, Simone A Padoan

| Title | Authors | Year | Actions |

|---|

Comments (0)