Authors

Summary

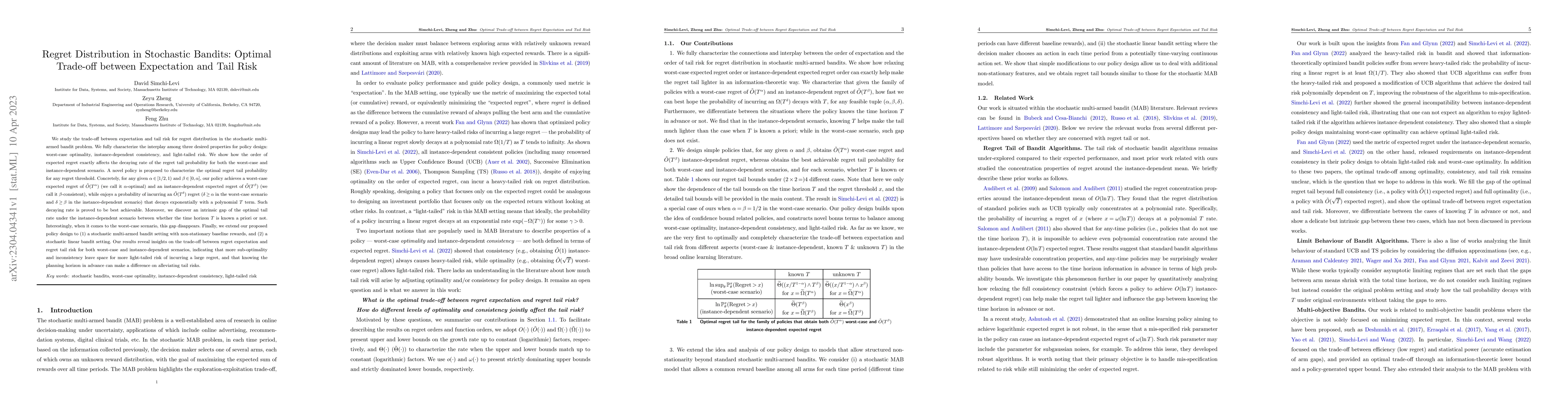

We study the trade-off between expectation and tail risk for regret distribution in the stochastic multi-armed bandit problem. We fully characterize the interplay among three desired properties for policy design: worst-case optimality, instance-dependent consistency, and light-tailed risk. We show how the order of expected regret exactly affects the decaying rate of the regret tail probability for both the worst-case and instance-dependent scenario. A novel policy is proposed to characterize the optimal regret tail probability for any regret threshold. Concretely, for any given $\alpha\in[1/2, 1)$ and $\beta\in[0, \alpha]$, our policy achieves a worst-case expected regret of $\tilde O(T^\alpha)$ (we call it $\alpha$-optimal) and an instance-dependent expected regret of $\tilde O(T^\beta)$ (we call it $\beta$-consistent), while enjoys a probability of incurring an $\tilde O(T^\delta)$ regret ($\delta\geq\alpha$ in the worst-case scenario and $\delta\geq\beta$ in the instance-dependent scenario) that decays exponentially with a polynomial $T$ term. Such decaying rate is proved to be best achievable. Moreover, we discover an intrinsic gap of the optimal tail rate under the instance-dependent scenario between whether the time horizon $T$ is known a priori or not. Interestingly, when it comes to the worst-case scenario, this gap disappears. Finally, we extend our proposed policy design to (1) a stochastic multi-armed bandit setting with non-stationary baseline rewards, and (2) a stochastic linear bandit setting. Our results reveal insights on the trade-off between regret expectation and regret tail risk for both worst-case and instance-dependent scenarios, indicating that more sub-optimality and inconsistency leave space for more light-tailed risk of incurring a large regret, and that knowing the planning horizon in advance can make a difference on alleviating tail risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDesign-Based Bandits Under Network Interference: Trade-Off Between Regret and Statistical Inference

Chuanhao Li, Huazheng Wang, Haoxuan Li et al.

On Bits and Bandits: Quantifying the Regret-Information Trade-off

Nir Weinberger, Shie Mannor, Nadav Merlis et al.

KL-UCB-switch: optimal regret bounds for stochastic bandits from both a distribution-dependent and a distribution-free viewpoints

Gilles Stoltz, Hédi Hadiji, Pierre Menard et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)