Authors

Summary

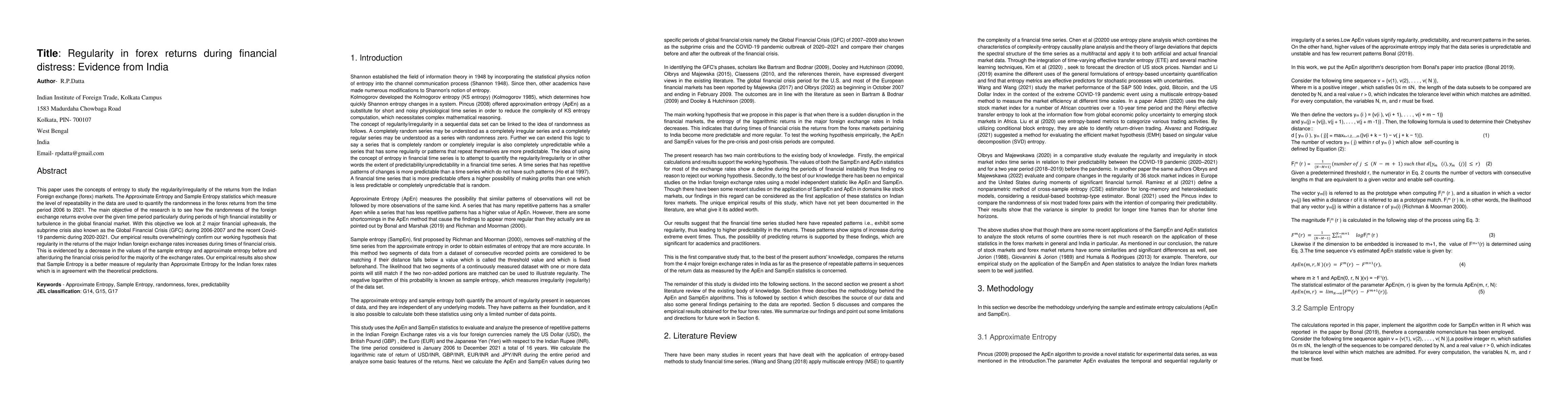

This paper uses the concepts of entropy to study the regularity/irregularity of the returns from the Indian Foreign exchange (forex) markets. The Approximate Entropy and Sample Entropy statistics which measure the level of repeatability in the data are used to quantify the randomness in the forex returns from the time period 2006 to 2021. The main objective of the research is to see how the randomness of the foreign exchange returns evolve over the given time period particularly during periods of high financial instability or turbulence in the global financial market. With this objective we look at 2 major financial upheavals, the subprime crisis also known as the Global Financial Crisis (GFC) during 2006-2007 and the recent Covid-19 pandemic during 2020-2021. Our empirical results overwhelmingly confirm our working hypothesis that regularity in the returns of the major Indian foreign exchange rates increases during times of financial crisis. This is evidenced by a decrease in the values of the sample entropy and approximate entropy before and after/during the financial crisis period for the majority of the exchange rates. Our empirical results also show that Sample Entropy is a better measure of regularity than Approximate Entropy for the Indian forex rates which is in agreement with the theoretical predictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)