Summary

There has been considerable advance in understanding the properties of sparse regularization procedures in high-dimensional models. In time series context, it is mostly restricted to Gaussian autoregressions or mixing sequences. We study oracle properties of LASSO estimation of weakly sparse vector-autoregressive models with heavy tailed, weakly dependent innovations with virtually no assumption on the conditional heteroskedasticity. In contrast to current literature, our innovation process satisfy an $L^1$ mixingale type condition on the centered conditional covariance matrices. This condition covers $L^1$-NED sequences and strong ($\alpha$-) mixing sequences as particular examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

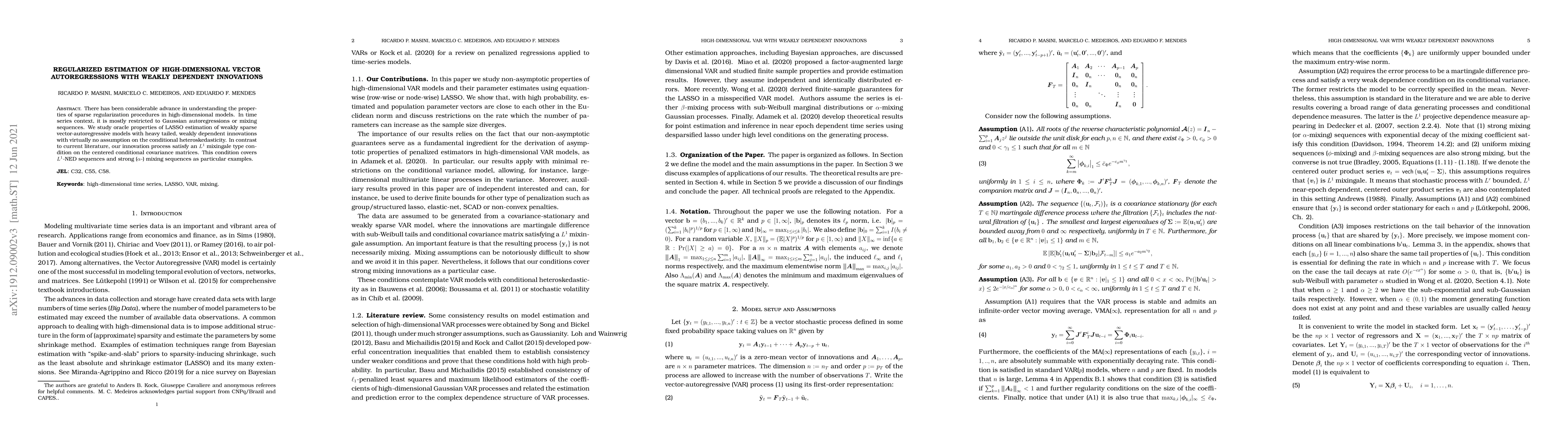

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)