Authors

Summary

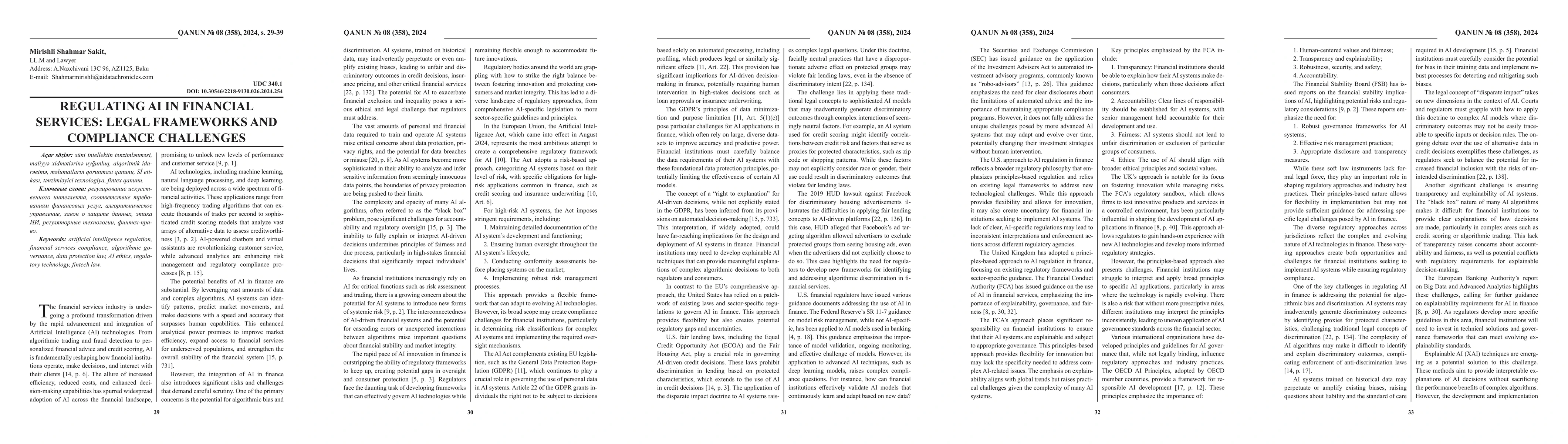

This article examines the evolving landscape of artificial intelligence (AI) regulation in financial services, detailing the legal frameworks and compliance challenges posed by rapid technological adoption. By reviewing current legislation, industry guidelines, and real-world use cases, it highlights how AI-driven processes, from fraud detection to algorithmic trading, offer efficiency gains yet introduce significant risks, including algorithmic bias, data privacy breaches, and lack of transparency in automated decision-making. The study compares regulatory approaches across major jurisdictions such as the European Union, United States, and United Kingdom, identifying both universal concerns, like the need for explainability and robust data protection, and region-specific compliance requirements that impact the implementation of high-risk AI applications. Additionally, it underscores emerging areas of focus, such as liability for AI-driven errors, systemic risks posed by interlinked AI systems, and the ethical considerations of technology-driven financial exclusion. The findings reveal gaps in existing rules and emphasize the necessity for adaptive, technology-neutral policies capable of fostering innovation while safeguarding consumer rights and market integrity. The article concludes by proposing a principled regulatory model that balances flexibility with enforceable standards, advocating closer collaboration between policymakers, financial institutions, and AI developers to ensure a secure, fair, and forward-looking framework for AI in finance.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research methodology involves a comprehensive review of existing literature, regulatory approaches, and practical use cases in financial services to analyze the legal frameworks and compliance challenges posed by AI.

Key Results

- AI-driven financial processes offer efficiency gains but introduce significant risks, including algorithmic bias, data privacy breaches, and lack of transparency.

- Regulatory approaches vary across jurisdictions such as the EU, US, and UK, with common concerns like explainability and data protection, and region-specific requirements.

- Emerging areas of focus include AI liability for errors, systemic risks from interconnected AI systems, and ethical considerations of technology-driven financial exclusion.

- Existing rules have gaps, necessitating adaptive, technology-neutral policies to foster innovation while safeguarding consumer rights and market integrity.

- A principled regulatory model balancing flexibility with enforceable standards is proposed, advocating for collaboration between policymakers, financial institutions, and AI developers.

Significance

This research is crucial as it identifies and addresses the complex regulatory landscape surrounding AI in financial services, aiming to ensure secure, fair, and innovative frameworks that protect consumers and maintain market integrity.

Technical Contribution

The paper presents a comparative analysis of AI regulation in financial services across major jurisdictions, highlighting universal concerns and region-specific requirements.

Novelty

The research distinguishes itself by emphasizing the need for adaptive, technology-neutral policies and proposing a balanced regulatory model that fosters innovation while ensuring consumer protection and market stability.

Limitations

- The study does not cover all emerging AI applications in finance, focusing primarily on established use cases and regulatory responses.

- It may not fully capture the rapid pace of technological advancements and their implications for regulation.

Future Work

- Further research could explore the impact of niche AI applications and their regulatory needs.

- Investigating the effectiveness of proposed regulatory models in practice over time.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAgentic AI for Financial Crime Compliance

Henrik Axelsen, Valdemar Licht, Jan Damsgaard

Third-party compliance reviews for frontier AI safety frameworks

Jonas Schuett, Lennart Heim, Kevin Wei et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)