Authors

Summary

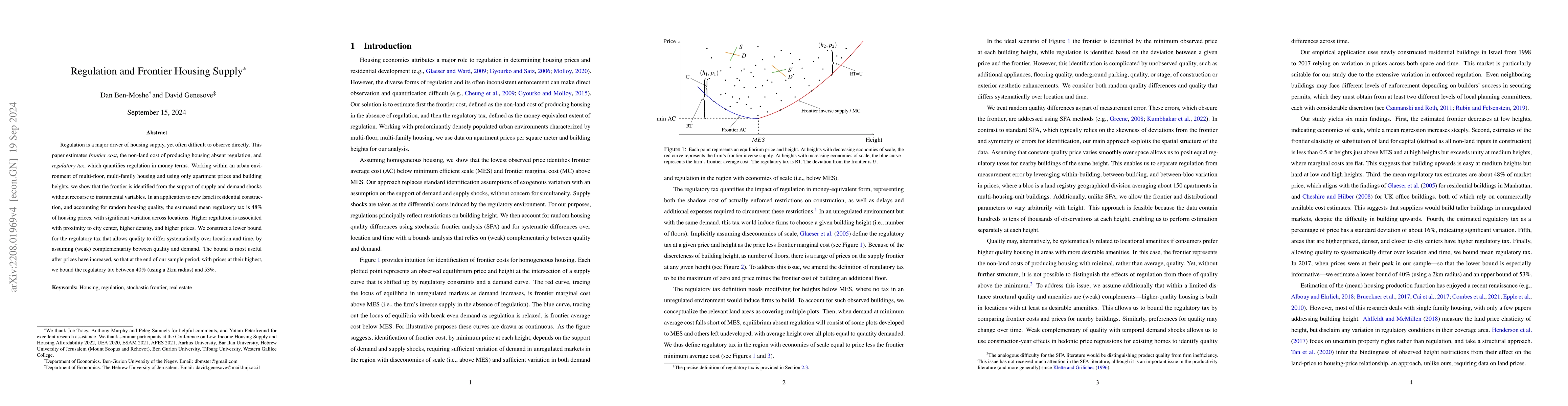

Regulation is a major driver of housing supply, yet often not easily observed. Using only apartment prices and building heights, we estimate $\textit{frontier costs}$, defined as housing production costs absent regulation. Identification uses conditions on the support of supply and demand shocks without recourse to instrumental variables. In an application to Israeli residential construction, we find on average 43% of housing price ascribable to regulation, but with substantial dispersion, and with higher rates in areas that are higher priced, denser, and closer to city centers. We also find economies of scale in frontier costs at low building heights. This estimation takes into account measurement error, which includes random unobserved structural quality. When allowing structural quality to vary with amenities (locational quality), and assuming weak complementarity (the return in price on structural quality is nondecreasing in amenities) among buildings within 1km, we bound mean regulation from below by 19% of prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrontier AI Regulation: Managing Emerging Risks to Public Safety

Sara Hooker, Jonas Schuett, Markus Anderljung et al.

An FDA for AI? Pitfalls and Plausibility of Approval Regulation for Frontier Artificial Intelligence

Carson Ezell, Daniel Carpenter

| Title | Authors | Year | Actions |

|---|

Comments (0)