Authors

Summary

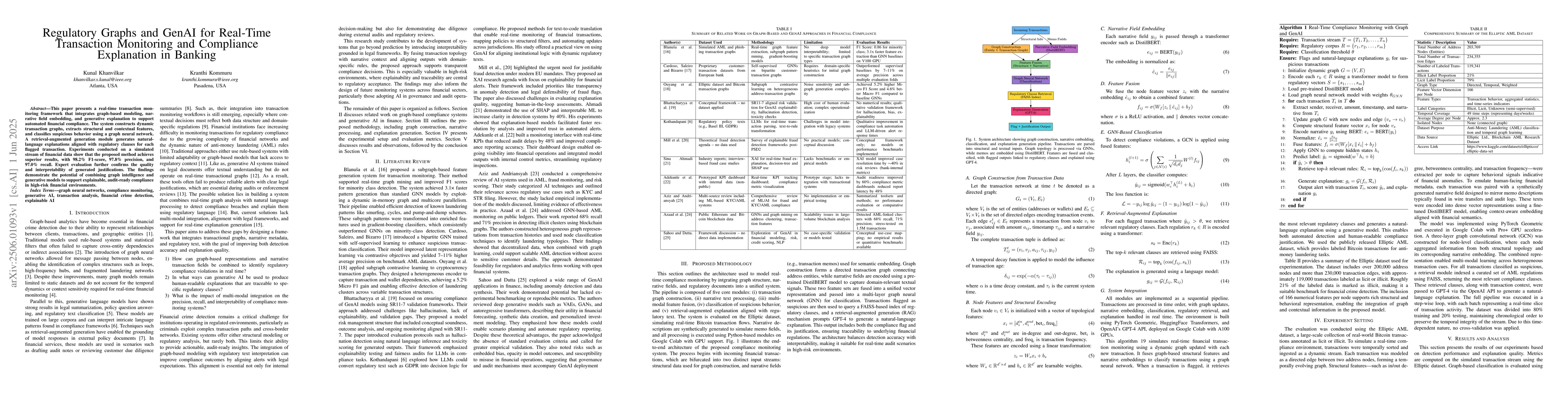

This paper presents a real-time transaction monitoring framework that integrates graph-based modeling, narrative field embedding, and generative explanation to support automated financial compliance. The system constructs dynamic transaction graphs, extracts structural and contextual features, and classifies suspicious behavior using a graph neural network. A retrieval-augmented generation module generates natural language explanations aligned with regulatory clauses for each flagged transaction. Experiments conducted on a simulated stream of financial data show that the proposed method achieves superior results, with 98.2% F1-score, 97.8% precision, and 97.0% recall. Expert evaluation further confirms the quality and interpretability of generated justifications. The findings demonstrate the potential of combining graph intelligence and generative models to support explainable, audit-ready compliance in high-risk financial environments.

AI Key Findings

Generated Jun 09, 2025

Methodology

The framework integrates graph-based modeling, narrative field embedding, and generative explanation. It constructs dynamic transaction graphs, extracts structural and contextual features, and uses a graph neural network for suspicious behavior classification. A retrieval-augmented generation module produces natural language explanations aligned with regulatory clauses.

Key Results

- Achieved 98.2% F1-score, 97.8% precision, and 97.0% recall in experiments on simulated financial data.

- Expert evaluation confirmed the quality and interpretability of generated justifications.

Significance

This research demonstrates the potential of combining graph intelligence and generative models to support explainable, audit-ready compliance in high-risk financial environments, enhancing real-time transaction monitoring and regulatory adherence.

Technical Contribution

The development of a real-time transaction monitoring framework that integrates graph neural networks and generative models for compliance explanation.

Novelty

This work combines graph-based modeling with generative AI for compliance explanation, offering superior performance and interpretability compared to existing methods.

Limitations

- The method was evaluated on simulated data; real-world performance may vary.

- Potential challenges in handling diverse and evolving regulatory clauses not covered in the training data.

Future Work

- Explore applicability on real-world financial datasets for validation.

- Investigate methods to adapt the system for handling new or changing regulatory requirements.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReal-time Multi-modal Object Detection and Tracking on Edge for Regulatory Compliance Monitoring

Jiajun Liu, Ziwei Wang, Jia Syuen Lim et al.

A Secure Blockchain-Assisted Framework for Real-Time Maritime Environmental Compliance Monitoring

Mohamed Rahouti, William C. Quigley, Gary M. Weiss

Reviewing Uses of Regulatory Compliance Monitoring

Luise Pufahl, Finn Klessascheck

Standardizing Intelligence: Aligning Generative AI for Regulatory and Operational Compliance

Joseph Marvin Imperial, Harish Tayyar Madabushi, Matthew D. Jones

No citations found for this paper.

Comments (0)