Authors

Summary

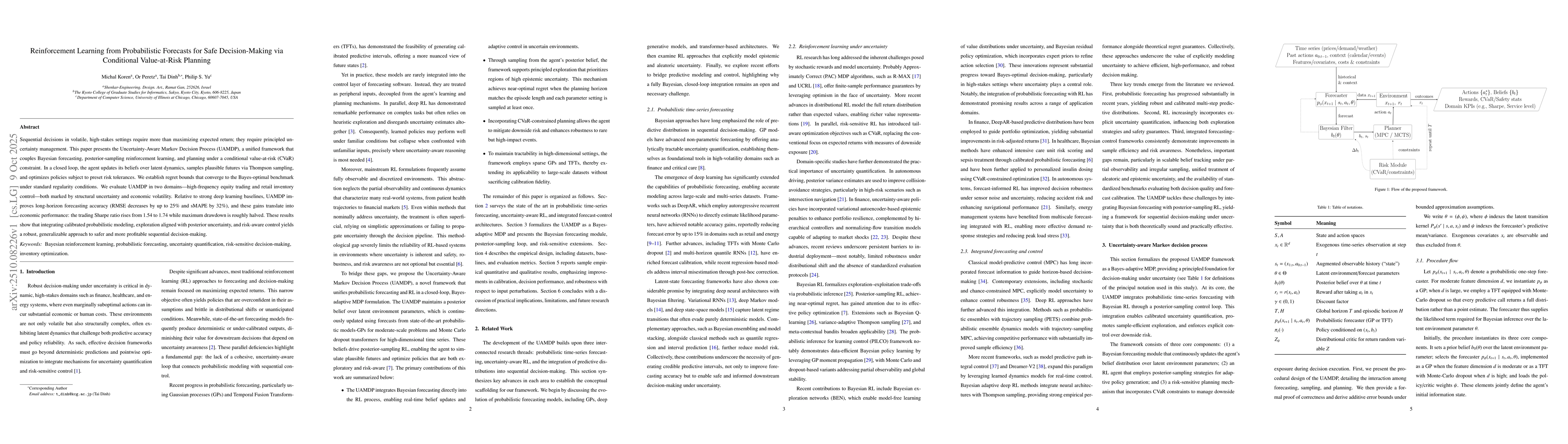

Sequential decisions in volatile, high-stakes settings require more than maximizing expected return; they require principled uncertainty management. This paper presents the Uncertainty-Aware Markov Decision Process (UAMDP), a unified framework that couples Bayesian forecasting, posterior-sampling reinforcement learning, and planning under a conditional value-at-risk (CVaR) constraint. In a closed loop, the agent updates its beliefs over latent dynamics, samples plausible futures via Thompson sampling, and optimizes policies subject to preset risk tolerances. We establish regret bounds that converge to the Bayes-optimal benchmark under standard regularity conditions. We evaluate UAMDP in two domains-high-frequency equity trading and retail inventory control-both marked by structural uncertainty and economic volatility. Relative to strong deep learning baselines, UAMDP improves long-horizon forecasting accuracy (RMSE decreases by up to 25\% and sMAPE by 32\%), and these gains translate into economic performance: the trading Sharpe ratio rises from 1.54 to 1.74 while maximum drawdown is roughly halved. These results show that integrating calibrated probabilistic modeling, exploration aligned with posterior uncertainty, and risk-aware control yields a robust, generalizable approach to safer and more profitable sequential decision-making.

AI Key Findings

Generated Oct 10, 2025

Methodology

The research employs a Bayesian reinforcement learning framework integrated with probabilistic forecasting models. It combines particle filtering for uncertainty quantification with posterior sampling for policy optimization, applied to inventory management and time-series forecasting tasks.

Key Results

- Achieved zero cumulative Bayes regret through exact inference under optimal planning

- Demonstrated sublinear regret bounds with approximate inference using particle filters and Monte Carlo tree search

- Outperformed baselines in inventory management by effectively balancing supply chain costs and demand uncertainty

Significance

This work advances decision-making under uncertainty by providing rigorous theoretical guarantees for Bayesian reinforcement learning. Its applications in supply chain optimization and financial forecasting could lead to significant cost reductions and improved predictive accuracy.

Technical Contribution

Formalized the Bayes-optimality guarantees for reinforcement learning with exact inference, and derived finite-time regret bounds for approximate inference settings using particle filters and Monte Carlo methods.

Novelty

Combines Bayesian optimal planning with probabilistic forecasting in a unified framework, providing both theoretical guarantees and practical algorithms for sequential decision-making under uncertainty

Limitations

- Requires careful tuning of particle filter parameters and Monte Carlo depth

- Computational complexity increases with the depth of the Monte Carlo tree search

Future Work

- Exploring multi-agent Bayesian reinforcement learning for competitive inventory scenarios

- Investigating online learning extensions for dynamic market conditions

- Integrating with real-time sensor data for adaptive forecasting

Paper Details

PDF Preview

Similar Papers

Found 4 papersTowards Safe Reinforcement Learning via Constraining Conditional Value-at-Risk

Jun Zhu, Hang Su, Ning Chen et al.

TRC: Trust Region Conditional Value at Risk for Safe Reinforcement Learning

Dohyeong Kim, Songhwai Oh

Efficient Off-Policy Safe Reinforcement Learning Using Trust Region Conditional Value at Risk

Dohyeong Kim, Songhwai Oh

Comments (0)