Authors

Summary

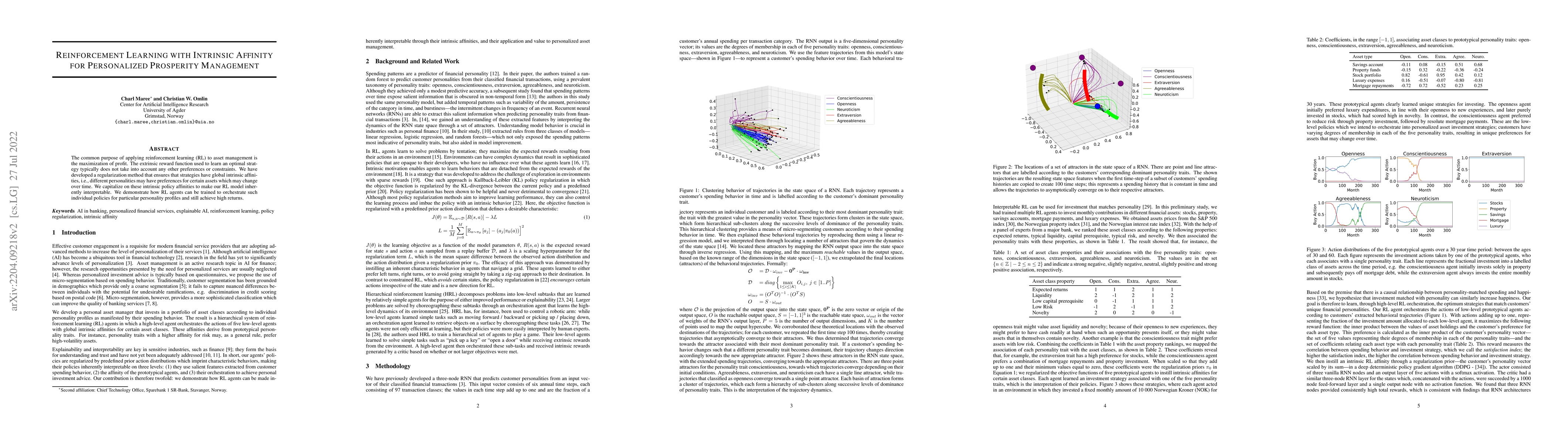

The common purpose of applying reinforcement learning (RL) to asset management is the maximization of profit. The extrinsic reward function used to learn an optimal strategy typically does not take into account any other preferences or constraints. We have developed a regularization method that ensures that strategies have global intrinsic affinities, i.e., different personalities may have preferences for certain assets which may change over time. We capitalize on these intrinsic policy affinities to make our RL model inherently interpretable. We demonstrate how RL agents can be trained to orchestrate such individual policies for particular personality profiles and still achieve high returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSymbolic Explanation of Affinity-Based Reinforcement Learning Agents with Markov Models

Charl Maree, Christian W. Omlin

DA-PFL: Dynamic Affinity Aggregation for Personalized Federated Learning

Xu Yang, Ye Wang, Jiyuan Feng et al.

Reinforcement Learning for Personalized Dialogue Management

Mark Hoogendoorn, Floris den Hengst, Frank van Harmelen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)