Summary

We consider the optimal reinsurance problem from the point of view of a direct insurer owning several dependent risks, assuming a maximal expected utility criterion and independent negotiation of reinsurance for each risk. Without any particular hypothesis on the dependency structure, we show that optimal treaties exist in a class of independent randomized contracts. We derive optimality conditions and show that under mild assumptions the optimal contracts are of classical (non-randomized) type. A specific for mof the optimality conditions applies in that case. We present a numerical scheme to solve the optimality conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

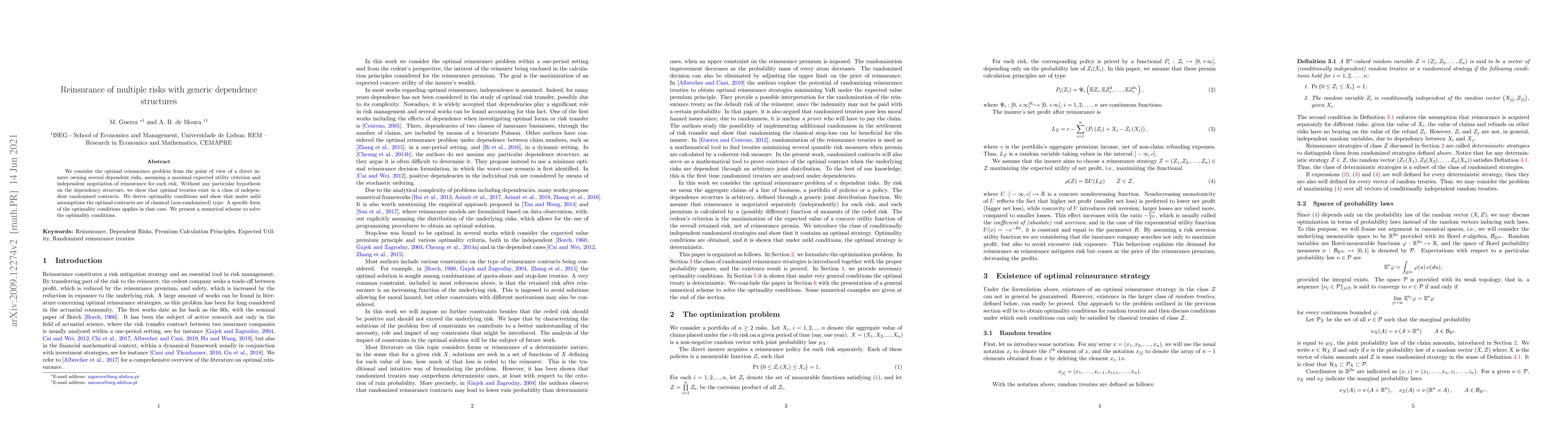

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Robust Reinsurance with Multiple Insurers

Sebastian Jaimungal, Silvana M. Pesenti, Emma Kroell

Bayesian optimal investment and reinsurance with dependent financial and insurance risks

Nicole Bäuerle, Gregor Leimcke

| Title | Authors | Year | Actions |

|---|

Comments (0)