Summary

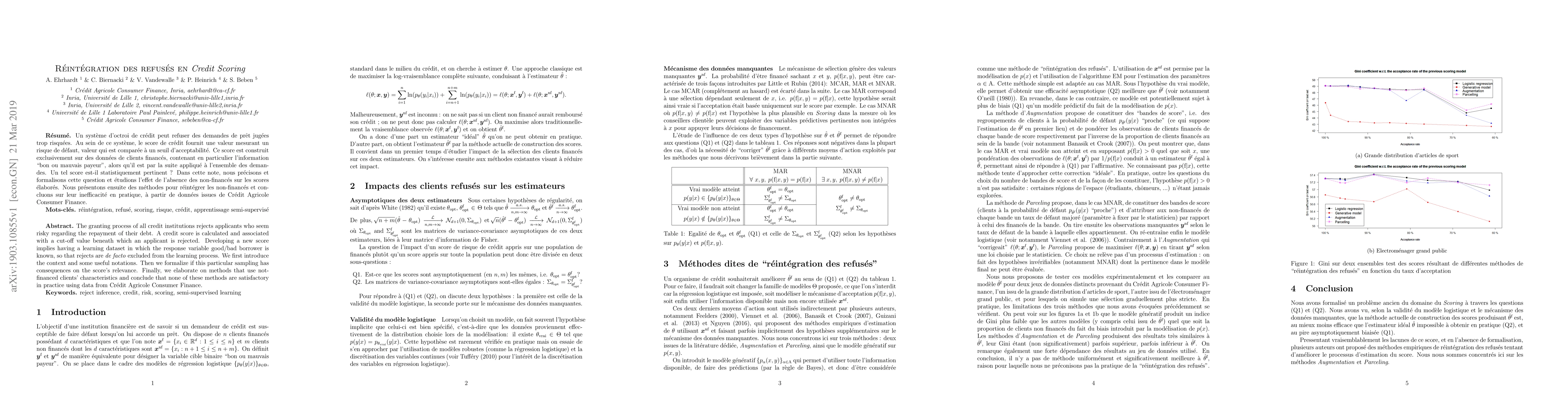

The granting process of all credit institutions rejects applicants who seem risky regarding the repayment of their debt. A credit score is calculated and associated with a cut-off value beneath which an applicant is rejected. Developing a new score implies having a learning dataset in which the response variable good/bad borrower is known, so that rejects are de facto excluded from the learning process. We first introduce the context and some useful notations. Then we formalize if this particular sampling has consequences on the score's relevance. Finally, we elaborate on methods that use not-financed clients' characteristics and conclude that none of these methods are satisfactory in practice using data from Cr\'edit Agricole Consumer Finance. ----- Un syst\`eme d'octroi de cr\'edit peut refuser des demandes de pr\^et jug\'ees trop risqu\'ees. Au sein de ce syst\`eme, le score de cr\'edit fournit une valeur mesurant un risque de d\'efaut, valeur qui est compar\'ee \`a un seuil d'acceptabilit\'e. Ce score est construit exclusivement sur des donn\'ees de clients financ\'es, contenant en particulier l'information `bon ou mauvais payeur', alors qu'il est par la suite appliqu\'e \`a l'ensemble des demandes. Un tel score est-il statistiquement pertinent ? Dans cette note, nous pr\'ecisons et formalisons cette question et \'etudions l'effet de l'absence des non-financ\'es sur les scores \'elabor\'es. Nous pr\'esentons ensuite des m\'ethodes pour r\'eint\'egrer les non-financ\'es et concluons sur leur inefficacit\'e en pratique, \`a partir de donn\'ees issues de Cr\'edit Agricole Consumer Finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)