Authors

Summary

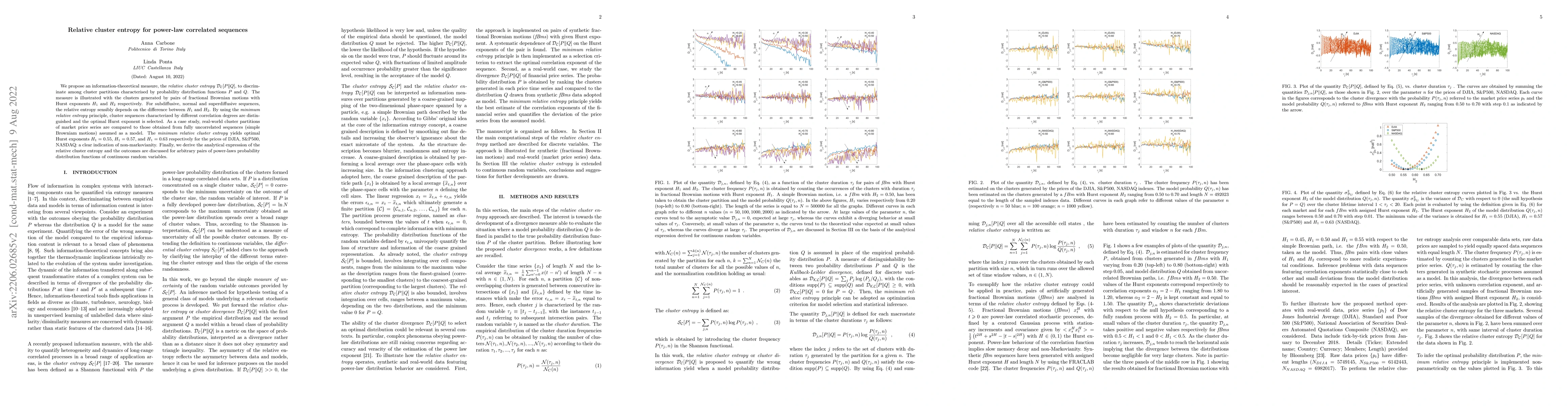

We propose an information-theoretical measure, the \textit{relative cluster entropy} $\mathcal{D_{C}}[P \| Q] $, to discriminate among cluster partitions characterised by probability distribution functions $P$ and $Q$. The measure is illustrated with the clusters generated by pairs of fractional Brownian motions with Hurst exponents $H_1$ and $H_2$ respectively. For subdiffusive, normal and superdiffusive sequences, the relative entropy sensibly depends on the difference between $H_1$ and $H_2$. By using the \textit{minimum relative entropy} principle, cluster sequences characterized by different correlation degrees are distinguished and the optimal Hurst exponent is selected. As a case study, real-world cluster partitions of market price series are compared to those obtained from fully uncorrelated sequences (simple Browniam motions) assumed as a model. The \textit{minimum relative cluster entropy} yields optimal Hurst exponents $H_1=0.55$, $H_1=0.57$, and $H_1=0.63$ respectively for the prices of DJIA, S\&P500, NASDAQ: a clear indication of non-markovianity. Finally, we derive the analytical expression of the relative cluster entropy and the outcomes are discussed for arbitrary pairs of power-laws probability distribution functions of continuous random variables.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)