Summary

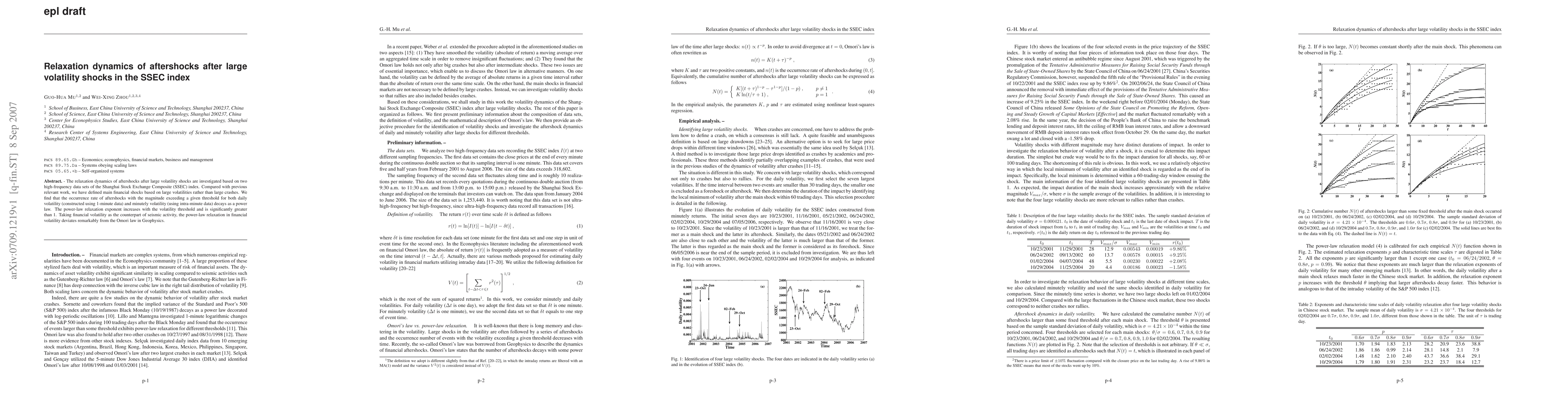

The relaxation dynamics of aftershocks after large volatility shocks are investigated based on two high-frequency data sets of the Shanghai Stock Exchange Composite (SSEC) index. Compared with previous relevant work, we have defined main financial shocks based on large volatilities rather than large crashes. We find that the occurrence rate of aftershocks with the magnitude exceeding a given threshold for both daily volatility (constructed using 1-minute data) and minutely volatility (using intra-minute data) decays as a power law. The power-law relaxation exponent increases with the volatility threshold and is significantly greater than 1. Taking financial volatility as the counterpart of seismic activity, the power-law relaxation in financial volatility deviates remarkably from the Omori law in Geophysics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)