Summary

The general and special repo rates are related with the prices of the European call- and American put-options. The evaluation takes into account specific business models of the parties in the repo agreement and the law restrictions. Using the repo-option relation, an alternative to the Black-Scholes method of option pricing is presented. The empirical data on the general and special repo rates are explained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

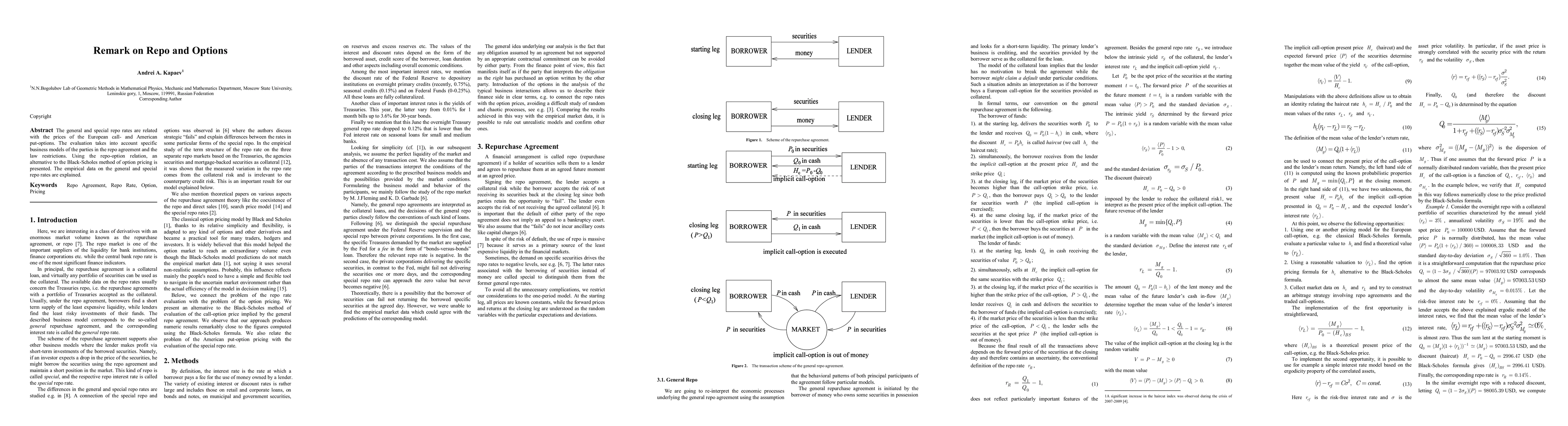

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)