Authors

Summary

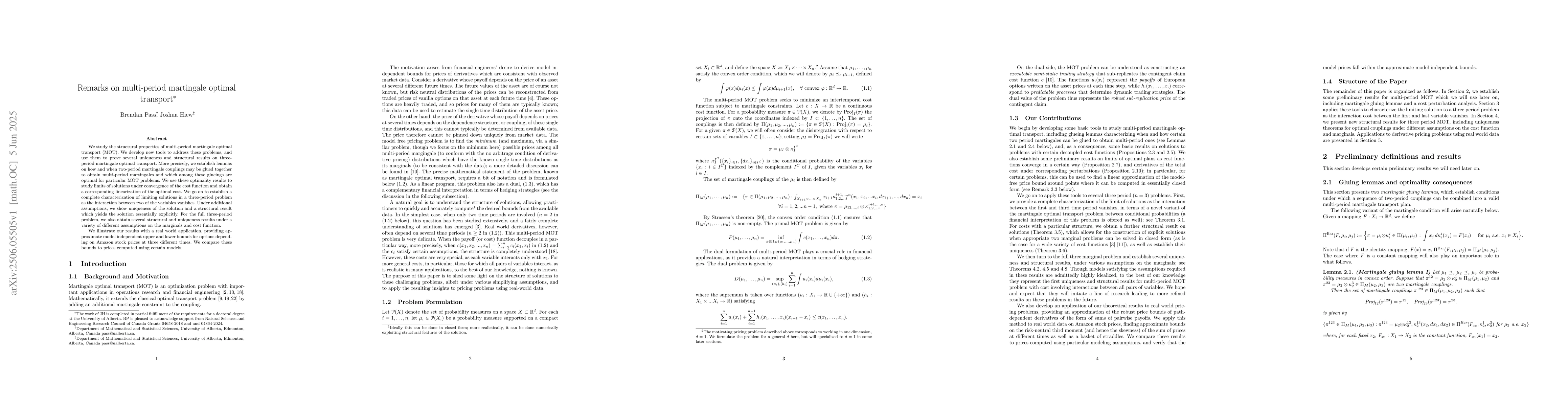

We study the structural properties of multi-period martingale optimal transport (MOT). We develop new tools to address these problems, and use them to prove several uniqueness and structural results on three-period martingale optimal transport. More precisely, we establish lemmas on how and when two-period martingale couplings may be glued together to obtain multi-period martingales and which among these glueings are optimal for particular MOT problems. We use these optimality results to study limits of solutions under convergence of the cost function and obtain a corresponding linearization of the optimal cost. We go on to establish a complete characterization of limiting solutions in a three-period problem as the interaction between two of the variables vanishes. Under additional assumptions, we show uniqueness of the solution and a structural result which yields the solution essentially explicitly. For the full three-period problem, we also obtain several structural and uniqueness results under a variety of different assumptions on the marginals and cost function. We illustrate our results with a real world application, providing approximate model independent upper and lower bounds for options depending on Amazon stock prices at three different times. We compare these bounds to prices computed using certain models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)