Summary

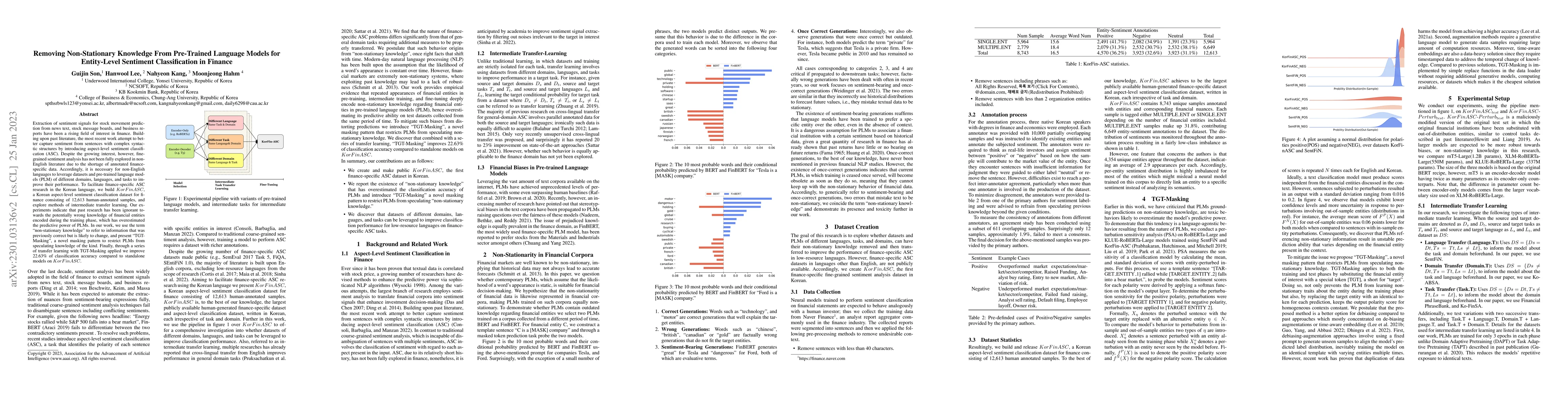

Extraction of sentiment signals from news text, stock message boards, and business reports, for stock movement prediction, has been a rising field of interest in finance. Building upon past literature, the most recent works attempt to better capture sentiment from sentences with complex syntactic structures by introducing aspect-level sentiment classification (ASC). Despite the growing interest, however, fine-grained sentiment analysis has not been fully explored in non-English literature due to the shortage of annotated finance-specific data. Accordingly, it is necessary for non-English languages to leverage datasets and pre-trained language models (PLM) of different domains, languages, and tasks to best their performance. To facilitate finance-specific ASC research in the Korean language, we build KorFinASC, a Korean aspect-level sentiment classification dataset for finance consisting of 12,613 human-annotated samples, and explore methods of intermediate transfer learning. Our experiments indicate that past research has been ignorant towards the potentially wrong knowledge of financial entities encoded during the training phase, which has overestimated the predictive power of PLMs. In our work, we use the term "non-stationary knowledge'' to refer to information that was previously correct but is likely to change, and present "TGT-Masking'', a novel masking pattern to restrict PLMs from speculating knowledge of the kind. Finally, through a series of transfer learning with TGT-Masking applied we improve 22.63% of classification accuracy compared to standalone models on KorFinASC.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinEntity: Entity-level Sentiment Classification for Financial Texts

Yi Yang, Yixuan Tang, Allen H Huang et al.

KAER: A Knowledge Augmented Pre-Trained Language Model for Entity Resolution

Lan Li, Bertram Ludäscher, Yiren Liu et al.

Identifying and Measuring Token-Level Sentiment Bias in Pre-trained Language Models with Prompts

Zhiyang Xu, Lifu Huang, Apoorv Garg et al.

Knowledge Rumination for Pre-trained Language Models

Peng Wang, Shengyu Mao, Fei Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)