Summary

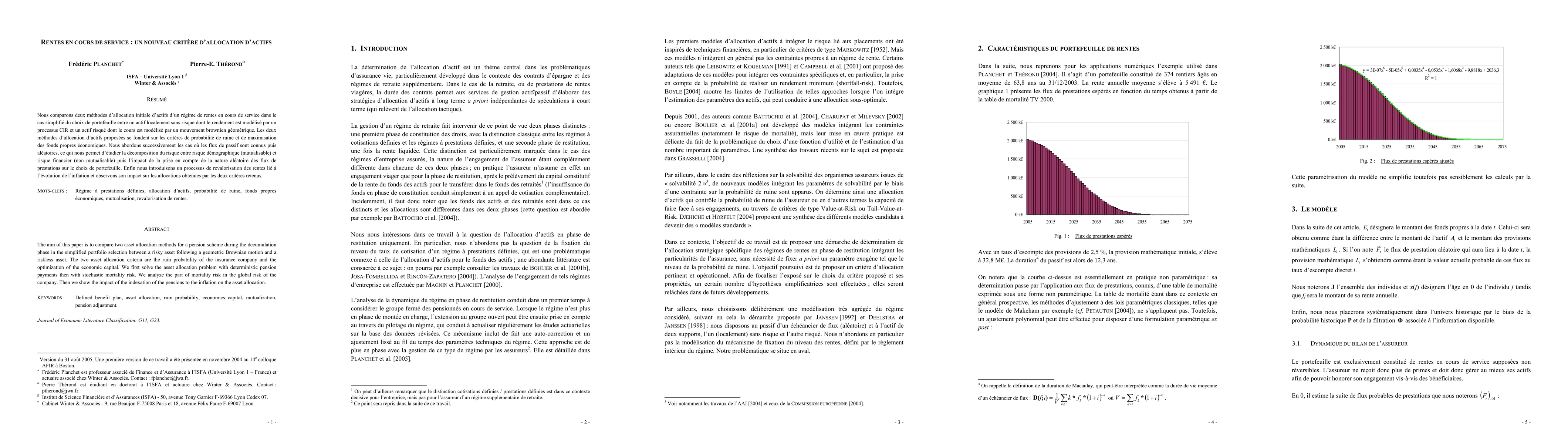

The aim of this paper is to compare two asset allocation methods for a pension scheme during the decumulation phase in the simplified portfolio selection between a risky asset following a geometric Brownian motion and a riskless asset. The two asset allocation criteria are the ruin probability of the insurance company and the optimization of the economic capital. We first solve the asset allocation problem with deterministic pension payments then with stochastic mortality risk. We analyze the part of mortality risk in the global risk of the company. Then we show the impact of the indexation of the pensions to the inflation on the asset allocation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)