Summary

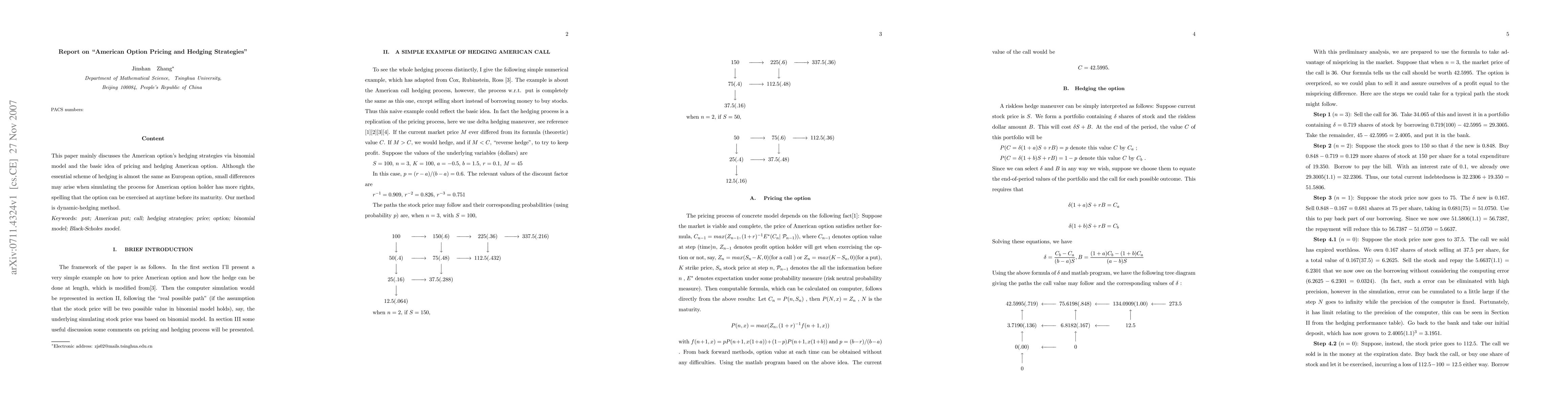

This paper mainly discusses the American option's hedging strategies via binomialmodel and the basic idea of pricing and hedging American option. Although the essential scheme of hedging is almost the same as European option, small differences may arise when simulating the process for American option holder has more rights, spelling that the option can be exercised at anytime before its maturity. Our method is dynamic-hedging method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplying Reinforcement Learning to Option Pricing and Hedging

Zoran Stoiljkovic

No citations found for this paper.

Comments (0)