Authors

Summary

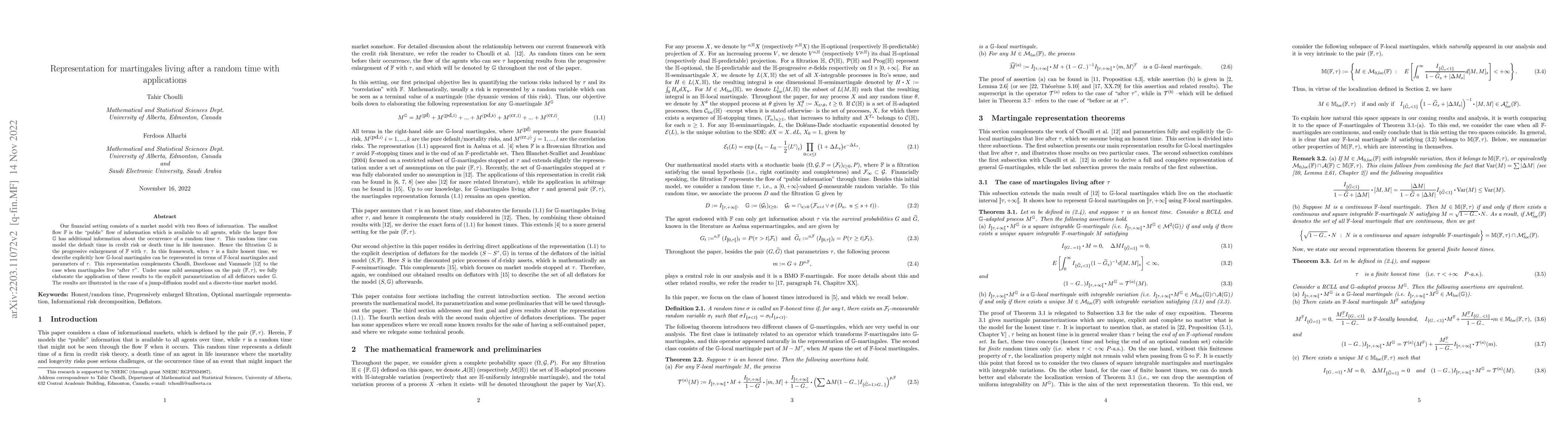

Our financial setting consists of a market model with two flows of information. The smallest flow F is the "public" flow of information which is available to all agents, while the larger flow G has additional information about the occurrence of a random time T. This random time can model the default time in credit risk or death time in life insurance. Hence the filtration G is the progressive enlargement of F with T. In this framework, under some mild assumptions on the pair (F, T), we describe explicitly how G-local martingales can be represented in terms of F-local martingale and parameters of T. This representation complements Choulli, Daveloose and Vanmaele \cite{ChoulliDavelooseVanmaele} to the case when martingales live "after T". The application of these results to the explicit parametrization of all deflators under G is fully elaborated. The results are illustrated on the case of jump-diffusion model and the discrete-time market model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)