Summary

In this paper we analyze a dynamic recursive extension of the (static) notion of a deviation measure and its properties. We study distribution invariant deviation measures and show that the only dynamic deviation measure which is law invariant and recursive is the variance. We also solve the problem of optimal risk-sharing generalizing classical risk-sharing results for variance through a dynamic inf-convolution problem involving a transformation of the original dynamic deviation measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

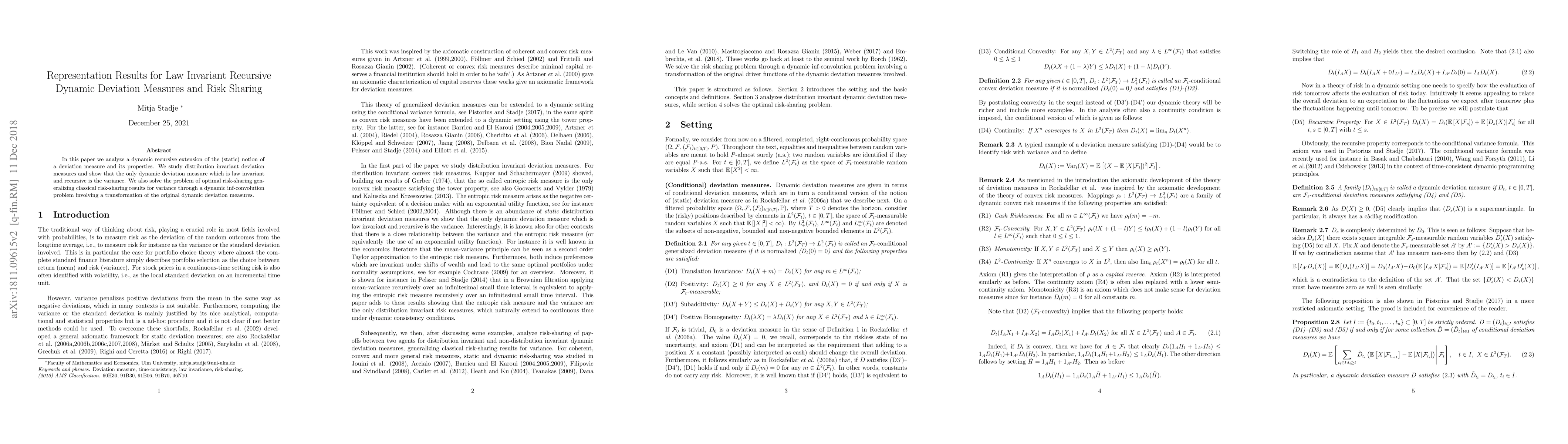

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutomatic Fatou Property of Law-invariant Risk Measures

Lei Li, Niushan Gao, Shengzhong Chen et al.

No citations found for this paper.

Comments (0)