Authors

Summary

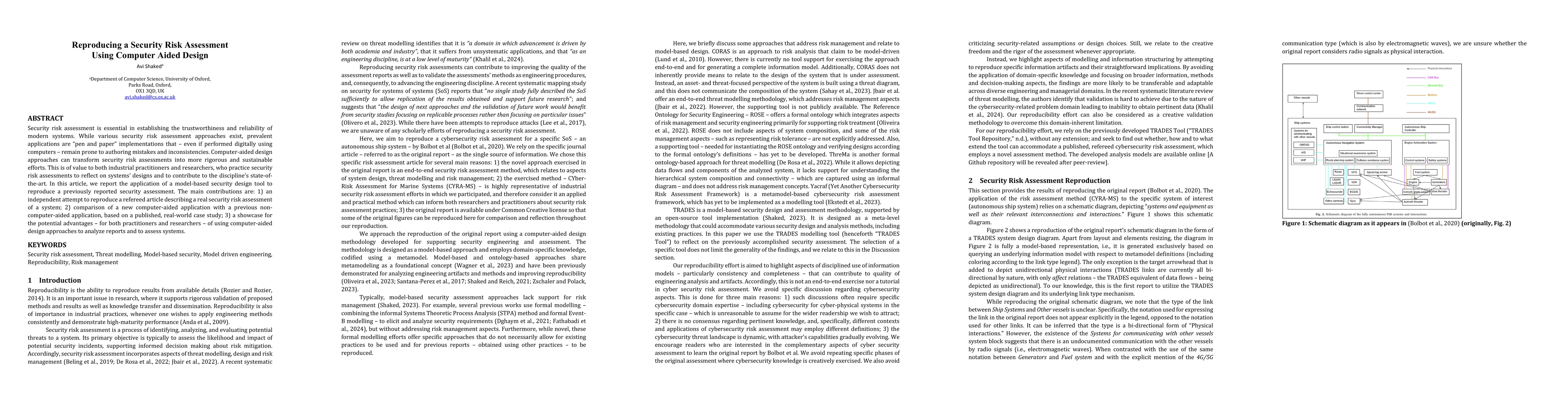

Security risk assessment is essential in establishing the trustworthiness and reliability of modern systems. While various security risk assessment approaches exist, prevalent applications are "pen and paper" implementations that -- even if performed digitally using computers -- remain prone to authoring mistakes and inconsistencies. Computer-aided design approaches can transform security risk assessments into more rigorous and sustainable efforts. This is of value to both industrial practitioners and researchers, who practice security risk assessments to reflect on systems' designs and to contribute to the discipline's state-of-the-art. In this article, we report the application of a model-based security design tool to reproduce a previously reported security assessment. The main contributions are: 1) an independent attempt to reproduce a refereed article describing a real security risk assessment of a system; 2) comparison of a new computer-aided application with a previous non-computer-aided application, based on a published, real-world case study; 3) a showcase for the potential advantages -- for both practitioners and researchers -- of using computer-aided design approaches to analyze reports and to assess systems.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study employed a model-based security design tool (TRADES) to reproduce and analyze a previously published security risk assessment of a ship system, comparing it with the original non-computer-aided approach.

Key Results

- TRADES identified inconsistencies in the original report, such as missing data flow endpoints and discrepancies in risk indices.

- The model-based approach enabled dynamic validation and visualization of risk scenarios, revealing a typo in the original risk matrix that affected risk ratings.

- The analysis demonstrated that computer-aided design improves reproducibility, consistency, and error detection in security risk assessments.

Significance

This research highlights the value of model-based approaches in enhancing the rigor and reliability of security risk assessments, providing a framework for systematic and reproducible analysis of complex systems.

Technical Contribution

Development and application of the TRADES tool for systematic risk assessment reproducibility, including dynamic risk matrix visualization and automated validation of data flows and risk scenarios.

Novelty

This work is the first to utilize TRADES Tool validation rules for reproducing and analyzing an external security risk assessment, showcasing its effectiveness in identifying inconsistencies and improving risk communication.

Limitations

- TRADES lacks the ability to explicitly model attacker identities, which limits detailed threat analysis.

- The study focused on information consistency rather than technical cybersecurity mechanisms, limiting the depth of security posture evaluation.

Future Work

- Integrate attacker modeling capabilities into TRADES to enhance threat analysis alignment with domain ontologies like Yarcaf and ROSE.

- Explore the application of model-based methodologies in other domains to establish broader 'fit for purpose' criteria for such tools.

Paper Details

PDF Preview

Similar Papers

Found 5 papersSALAD: Systematic Assessment of Machine Unlearing on LLM-Aided Hardware Design

Muhammad Shafique, Ramesh Karri, Jitendra Bhandari et al.

Computer-Aided Design of Personalized Occlusal Positioning Splints Using Multimodal 3D Data

Agnieszka Anna Tomaka, Dariusz Pojda, Michał Tarnawski et al.

TELSAFE: Security Gap Quantitative Risk Assessment Framework

Chandra Thapa, Sarah Ali Siddiqui, Wei Shao et al.

Comments (0)