Authors

Summary

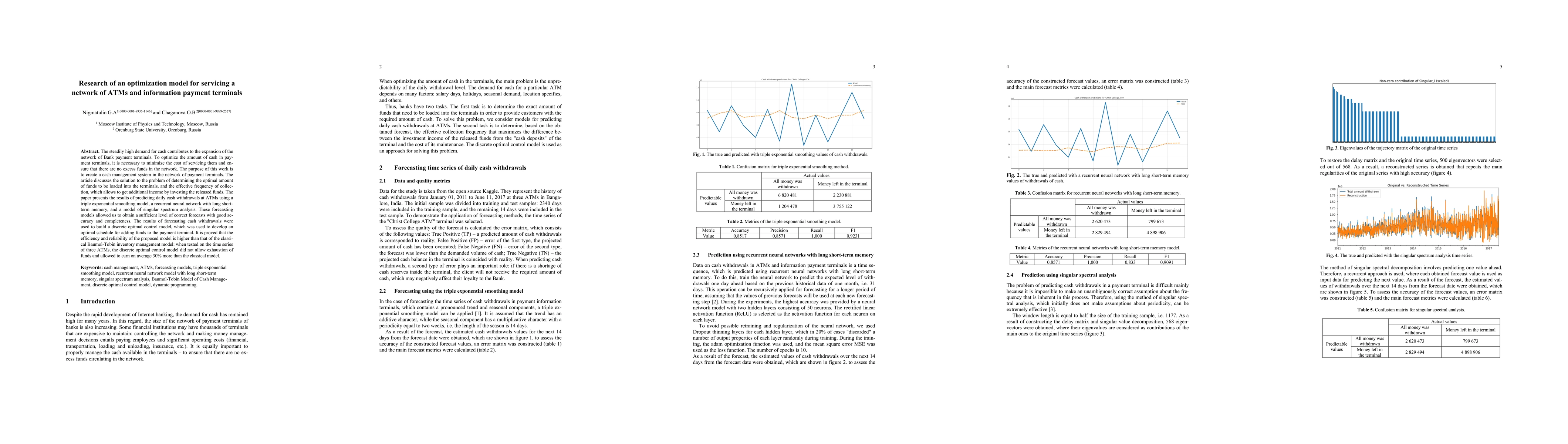

The steadily high demand for cash contributes to the expansion of the network of Bank payment terminals. To optimize the amount of cash in payment terminals, it is necessary to minimize the cost of servicing them and ensure that there are no excess funds in the network. The purpose of this work is to create a cash management system in the network of payment terminals. The article discusses the solution to the problem of determining the optimal amount of funds to be loaded into the terminals, and the effective frequency of collection, which allows to get additional income by investing the released funds. The paper presents the results of predicting daily cash withdrawals at ATMs using a triple exponential smoothing model, a recurrent neural network with long short-term memory, and a model of singular spectrum analysis. These forecasting models allowed us to obtain a sufficient level of correct forecasts with good accuracy and completeness. The results of forecasting cash withdrawals were used to build a discrete optimal control model, which was used to develop an optimal schedule for adding funds to the payment terminal. It is proved that the efficiency and reliability of the proposed model is higher than that of the classical Baumol-Tobin inventory management model: when tested on the time series of three ATMs, the discrete optimal control model did not allow exhaustion of funds and allowed to earn on average 30% more than the classical model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)