Summary

The decisions that human beings make to allocate time has significant bearing on economic output and to the sustenance of social networks. The time allocation problem motivates our formal analysis of the resource allocation game, where agents on a social network, who have asymmetric, private interaction preferences, make decisions on how to allocate time, a bounded endowment, over their neighbors. Unlike the well-known opinion formation game on a social network, our game appears not to be a potential game, and the Best-Response dynamics is non-differentiable making the analysis of Best-Response dynamics non-trivial. In our game, we consider two types of player behavior, namely optimistic or pessimistic, based on how they use their time endowment over their neighbors. To analyze Best-Response dynamics, we circumvent the problem of the game not being a potential game, through the lens of a novel two-level potential function approach. We show that the Best-Response dynamics converges point-wise to a Nash Equilibrium when players are all: optimistic; pessimistic; a mix of both types. Finally, we show that the Nash Equilibrium set is non-convex but connected, and Price of Anarchy is unbounded while Price of Stability is one. Extensive simulations over a stylized grid reveals that the distribution of quality of the convergence points is unimodal-we conjecture that presence of unimodality is tied to the connectedness of Nash Equilibrium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

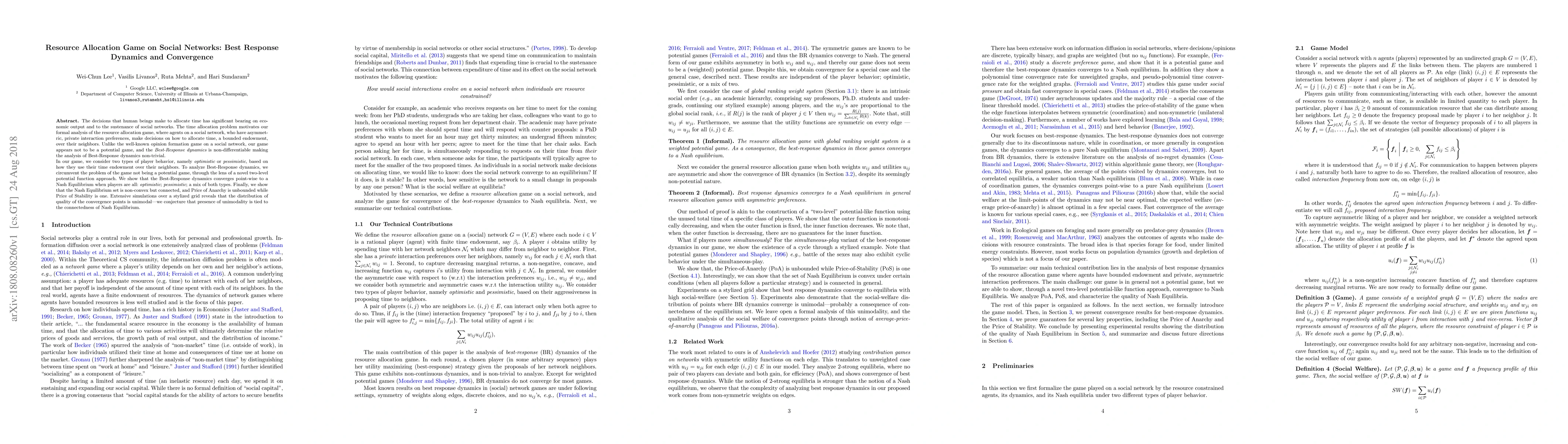

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBest Response Sequences and Tradeoffs in Submodular Resource Allocation Games

Jason R. Marden, Rohit Konda, Rahul Chandan et al.

No citations found for this paper.

Comments (0)