Summary

Financial institutions of all sizes are increasingly adopting Large Language Models (LLMs) to enhance credit assessments, deliver personalized client advisory services, and automate various language-intensive processes. However, effectively deploying LLMs requires careful management of stringent data governance requirements, heightened demands for interpretability, ethical responsibilities, and rapidly evolving regulatory landscapes. To address these challenges, we introduce a structured six-decision framework specifically designed for the financial sector, guiding organizations systematically from initial feasibility assessments to final deployment strategies. The framework encourages institutions to: (1) evaluate whether an advanced LLM is necessary at all, (2) formalize robust data governance and privacy safeguards, (3) establish targeted risk management mechanisms, (4) integrate ethical considerations early in the development process, (5) justify the initiative's return on investment (ROI) and strategic value, and only then (6) choose the optimal implementation pathway -- open-source versus proprietary, or in-house versus vendor-supported -- aligned with regulatory requirements and operational realities. By linking strategic considerations with practical steps such as pilot testing, maintaining comprehensive audit trails, and conducting ongoing compliance evaluations, this decision framework offers a structured roadmap for responsibly leveraging LLMs. Rather than acting as a rigid, one-size-fits-all solution, it shows how advanced language models can be thoughtfully integrated into existing workflows -- balancing innovation with accountability to uphold stakeholder trust and regulatory integrity.

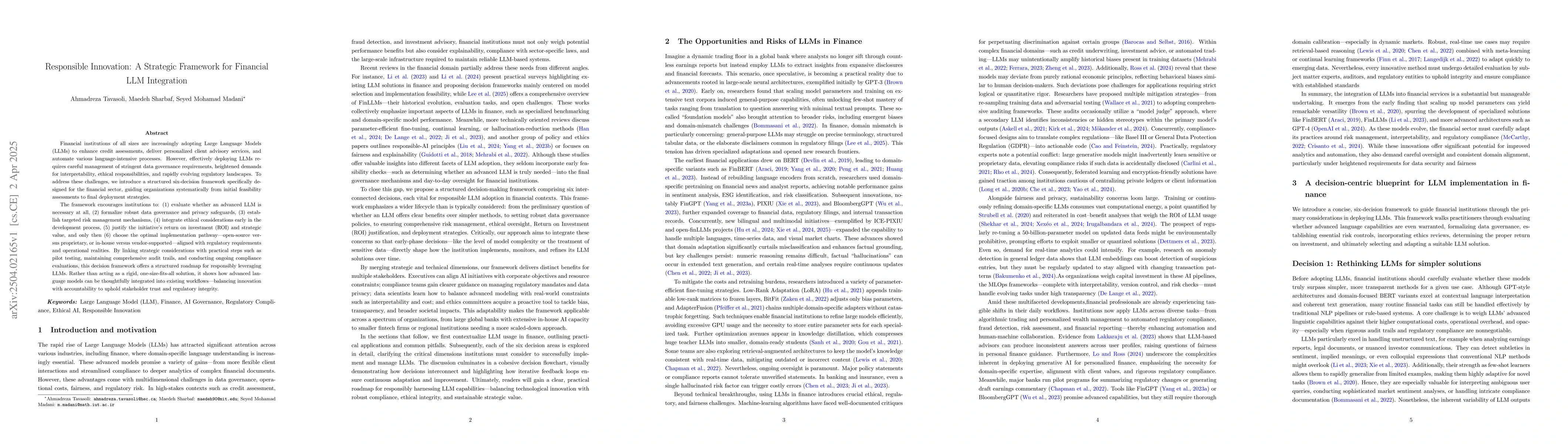

AI Key Findings

Generated Jun 10, 2025

Methodology

The research presents a structured six-decision framework for the financial sector to systematically integrate Large Language Models (LLMs), addressing challenges such as data governance, interpretability, ethics, and regulatory compliance.

Key Results

- A decision framework comprising six stages: necessity evaluation, data governance, risk management, ethical considerations, ROI justification, and implementation pathway selection.

- Emphasis on proactive ethical management of workforce transformations due to AI adoption, including upskilling, reskilling, and clear transition support.

- Identification of key governance dimensions for responsible LLM deployment: interpretability, validation, risk, bias, privacy, accountability, and lifecycle governance.

- Highlighting the importance of continuous governance and ethical oversight for responsible LLM adoption.

- Discussion on measuring LLM value and ROI, considering both tangible and intangible benefits, such as efficiency gains, revenue enhancements, brand perception, and innovation posture.

Significance

This research is significant as it provides a comprehensive, strategic framework for financial institutions to responsibly integrate LLMs, balancing innovation with accountability to uphold stakeholder trust and regulatory integrity.

Technical Contribution

The paper introduces a strategic decision-making framework specifically tailored for the financial sector to guide the integration of LLMs, addressing unique challenges and requirements.

Novelty

The research distinguishes itself by providing a structured, multi-dimensional approach to LLM integration in finance, emphasizing ethical considerations, governance, and continuous oversight, which are often overlooked in existing literature.

Limitations

- The framework may not account for all possible future regulatory changes or unforeseen ethical dilemmas.

- The effectiveness of the proposed framework heavily relies on the institution's commitment to ongoing monitoring, evaluation, and adaptation.

Future Work

- Further research could explore the long-term impacts of LLM integration on various financial sectors and stakeholders.

- Investigating the adaptability of the proposed framework across different cultural and regulatory contexts.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSCOR: A Framework for Responsible AI Innovation in Digital Ecosystems

Taha Mansouri, Mohammad Saleh Torkestani

Strategic Innovation Through Outsourcing: A Theoretical Review

Marfri Gambal, Aleksandre Asatiani, Julia Kotlarsky

STRIDE: A Tool-Assisted LLM Agent Framework for Strategic and Interactive Decision-Making

Chuanhao Li, Zhuoran Yang, Runhan Yang et al.

No citations found for this paper.

Comments (0)