Summary

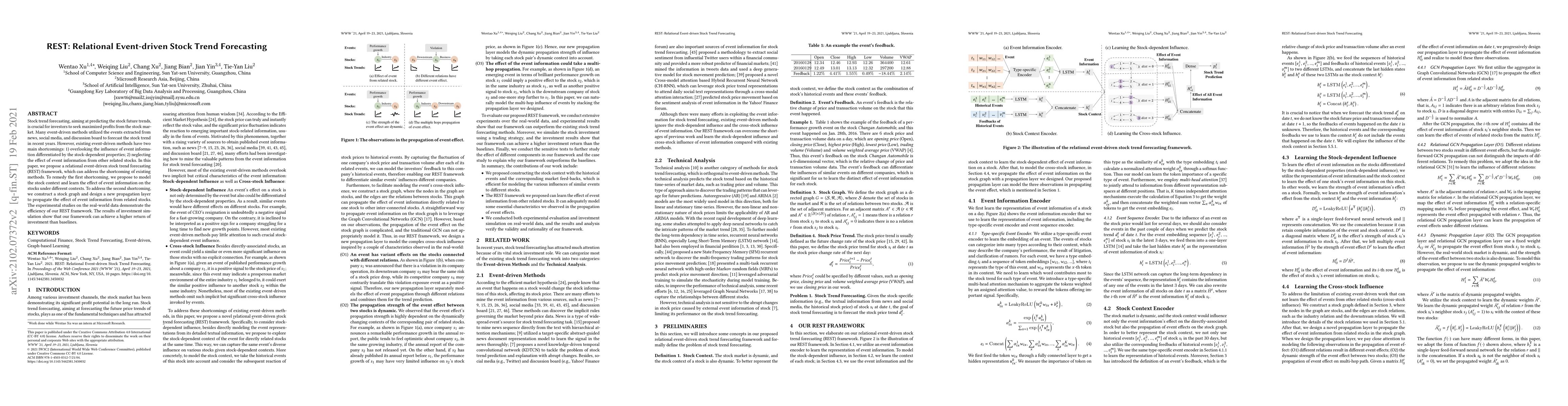

Stock trend forecasting, aiming at predicting the stock future trends, is crucial for investors to seek maximized profits from the stock market. Many event-driven methods utilized the events extracted from news, social media, and discussion board to forecast the stock trend in recent years. However, existing event-driven methods have two main shortcomings: 1) overlooking the influence of event information differentiated by the stock-dependent properties; 2) neglecting the effect of event information from other related stocks. In this paper, we propose a relational event-driven stock trend forecasting (REST) framework, which can address the shortcoming of existing methods. To remedy the first shortcoming, we propose to model the stock context and learn the effect of event information on the stocks under different contexts. To address the second shortcoming, we construct a stock graph and design a new propagation layer to propagate the effect of event information from related stocks. The experimental studies on the real-world data demonstrate the efficiency of our REST framework. The results of investment simulation show that our framework can achieve a higher return of investment than baselines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-Lingual News Event Correlation for Stock Market Trend Prediction

Seemab Latif, Rabia Latif, Sahar Arshad et al.

HIST: A Graph-based Framework for Stock Trend Forecasting via Mining Concept-Oriented Shared Information

Weiqing Liu, Jiang Bian, Yingce Xia et al.

Temporal-Relational Hypergraph Tri-Attention Networks for Stock Trend Prediction

Meng Wang, Xiaojie Li, Yilong Yin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)