Summary

How, and to what extent, does an interconnected financial system endogenously amplify external shocks? This paper attempts to reconcile some apparently different views emerged after the 2008 crisis regarding the nature and the relevance of contagion in financial networks. We develop a common framework encompassing several network contagion models and show that, regardless of the shock distribution and the network topology, precise ordering relationships on the level of aggregate systemic losses hold among models. We argue that the extent of contagion crucially depends on the amount of information that each model assumes to be available to market players. Under no uncertainty about the network structure and values of external assets, the well-known Eisenberg and Noe (2001) model applies, which delivers the lowest level of contagion. This is due to a property of loss conservation: aggregate losses after contagion are equal to the losses incurred by those institutions initially hit by a shock. This property implies that many contagion analyses rule out by construction any loss amplification, treating de facto an interconnected system as a single aggregate entity, where losses are simply mutualised. Under higher levels of uncertainty, as captured for instance by the DebtRank model, losses become non-conservative and get compounded through the network. This has important policy implications: by reducing the levels of uncertainty in times of distress (e.g. by obtaining specific data on the network) policymakers would be able to move towards more conservative scenarios. Empirically, we compare the magnitude of contagion across models on a sample of the largest European banks during the years 2006-2016. In particular, we analyse contagion effects as a function of the size of the shock and the type of external assets shocked.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

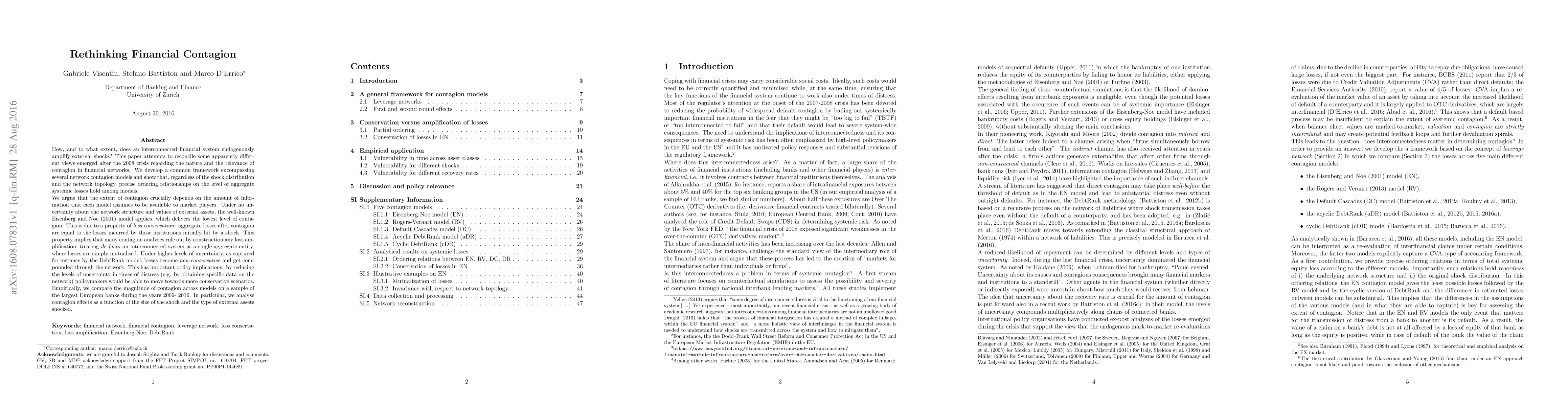

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)