Summary

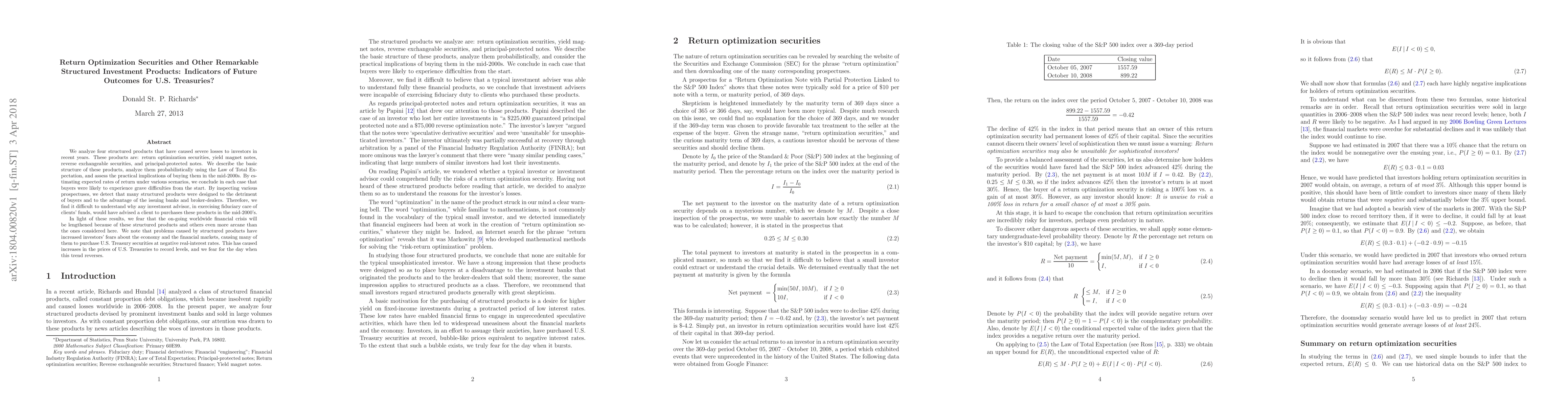

We analyze four structured products that have caused severe losses to investors in recent years. These products are: return optimization securities, yield magnet notes, reverse exchangeable securities, and principal-protected notes. We describe the basic structure of these products, analyze them probabilistically using the Law of Total Expectation, and assess the practical implications of buying them in the mid-2000s. By estimating expected rates of return under various scenarios, we conclude in each case that buyers were likely to experience grave difficulties from the start. By inspecting various prospectuses, we detect that many structured products were designed to the detriment of buyers and to the advantage of the issuing banks and broker-dealers. Therefore, we find it difficult to understand why any investment advisor, in exercising fiduciary care of clients' funds, would have advised a client to purchases these products in the mid-2000's. In light of these results, we fear that the on-going worldwide financial crisis will be lengthened because of these structured products and others even more arcane than the ones considered here. We note that problems caused by structured products have increased investors' fears about the economy and the financial markets, causing many of them to purchase U.S. Treasury securities at negative real-interest rates. This has caused increases in the prices of U.S. Treasuries to record levels, and we fear for the day when this trend reverses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Modeling Approach of Return and Volatility of Structured Investment Products with Caps and Floors

Jiaer He, Roberto Rivera

Transaction Profiling and Address Role Inference in Tokenized U.S. Treasuries

Di Wu, Xue Liu, Junliang Luo et al.

No citations found for this paper.

Comments (0)