Summary

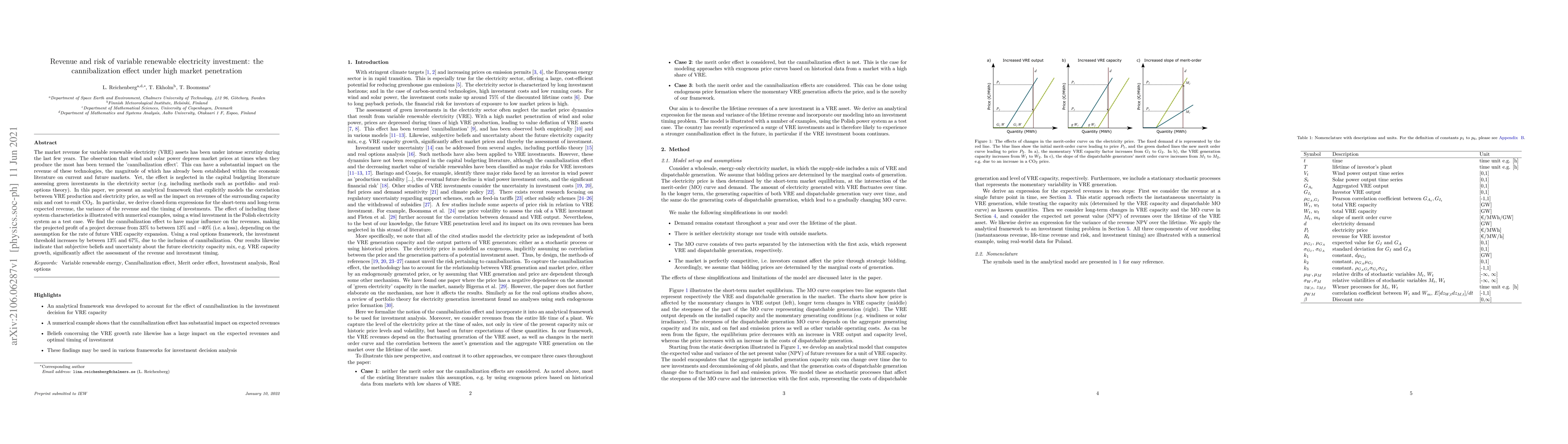

The market revenue for variable renewable electricity (VRE) assets has been under intense scrutiny during the last few years. The observation that wind and solar power depress market prices at times when they produce the most has been termed the 'cannibalization effect'. This can have a substantial impact on the revenue of these technologies, the magnitude of which has already been established within the economic literature on current and future markets. Yet, the effect is neglected in the capital budgeting literature assessing green investments in the electricity sector (e.g. including methods such as portfolio- and real-options theory). In this paper, we present an analytical framework that explicitly models the correlation between VRE production and electricity price, as well as the impact on revenues of the surrounding capacity mix and cost to emit CO$_2$. In particular, we derive closed-form expressions for the short-term and long-term expected revenue, the variance of the revenue and the timing of investments. The effect of including these system characteristics is illustrated with numerical examples, using a wind investment in the Polish electricity system as a test case. We find the cannibalization effect to have major influence on the revenues, making the projected profit of a project decrease from 33% to between 13% and -40% (i.e. a loss), depending on the assumption for the rate of future VRE capacity expansion. Using a real options framework, the investment threshold increases by between 13% and 67%, due to the inclusion of cannibalization. Our results likewise indicate that subjective beliefs and uncertainty about the future electricity capacity mix, e.g.\ VRE capacity growth, significantly affect the assessment of the revenue and investment timing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInvestment Decisions for Perfect and Imperfect Competition in Ireland's Electricity Market

Davoud Hosseinnezhad, Mel T. Devine, Seán McGarraghy

| Title | Authors | Year | Actions |

|---|

Comments (0)