Summary

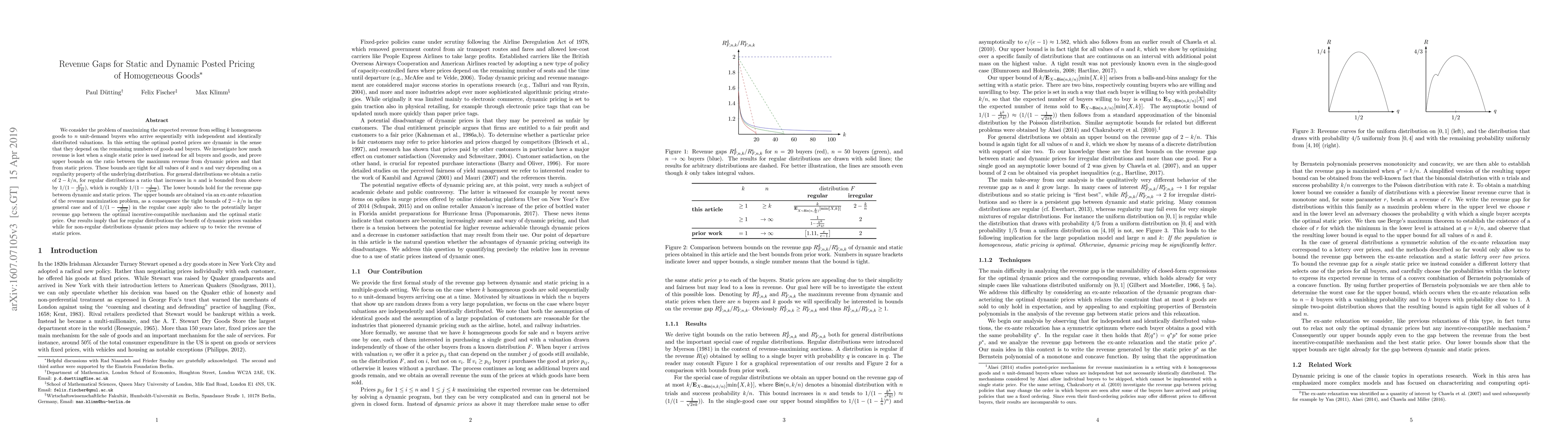

We consider the problem of maximizing the expected revenue from selling $k$ homogeneous goods to $n$ unit-demand buyers who arrive sequentially with independent and identically distributed valuations. In this setting the optimal posted prices are dynamic in the sense that they depend on the remaining numbers of goods and buyers. We investigate how much revenue is lost when a single static price is used instead for all buyers and goods, and prove upper bounds on the ratio between the maximum revenue from dynamic prices and that from static prices. These bounds are tight for all values of $k$ and $n$ and vary depending on a regularity property of the underlying distribution. For general distributions we obtain a ratio of $2-k/n$, for regular distributions a ratio that increases in $n$ and is bounded from above by $1/(1-k^k/(e^{k}k!))$, which is roughly $1/(1-1/(\sqrt{2\pi k}))$. The lower bounds hold for the revenue gap between dynamic and static prices. The upper bounds are obtained via an ex-ante relaxation of the revenue maximization problem, as a consequence the tight bounds of $2-k/n$ in the general case and of $1/(1-1/(\sqrt{2\pi k}))$ in the regular case apply also to the potentially larger revenue gap between the optimal incentive-compatible mechanism and the optimal static price. Our results imply that for regular distributions the benefit of dynamic prices vanishes while for non-regular distributions dynamic prices may achieve up to twice the revenue of static prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)