Authors

Summary

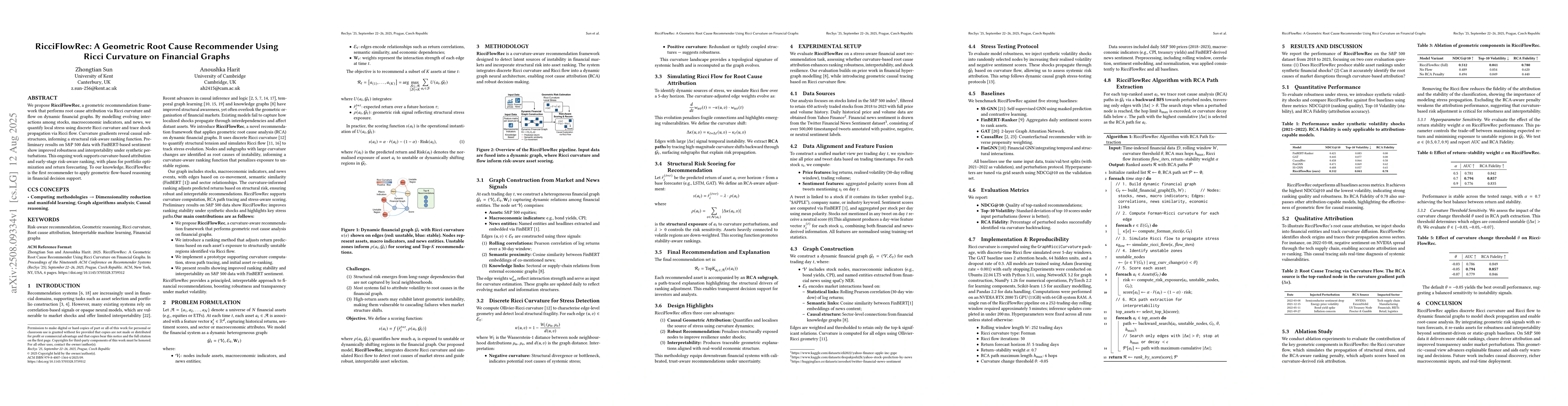

We propose RicciFlowRec, a geometric recommendation framework that performs root cause attribution via Ricci curvature and flow on dynamic financial graphs. By modelling evolving interactions among stocks, macroeconomic indicators, and news, we quantify local stress using discrete Ricci curvature and trace shock propagation via Ricci flow. Curvature gradients reveal causal substructures, informing a structural risk-aware ranking function. Preliminary results on S\&P~500 data with FinBERT-based sentiment show improved robustness and interpretability under synthetic perturbations. This ongoing work supports curvature-based attribution and early-stage risk-aware ranking, with plans for portfolio optimization and return forecasting. To our knowledge, RicciFlowRec is the first recommender to apply geometric flow-based reasoning in financial decision support.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOllivier curvature of random geometric graphs converges to Ricci curvature of their Riemannian manifolds

Dmitri Krioukov, Pim van der Hoorn, Gabor Lippner et al.

Comments (0)