Summary

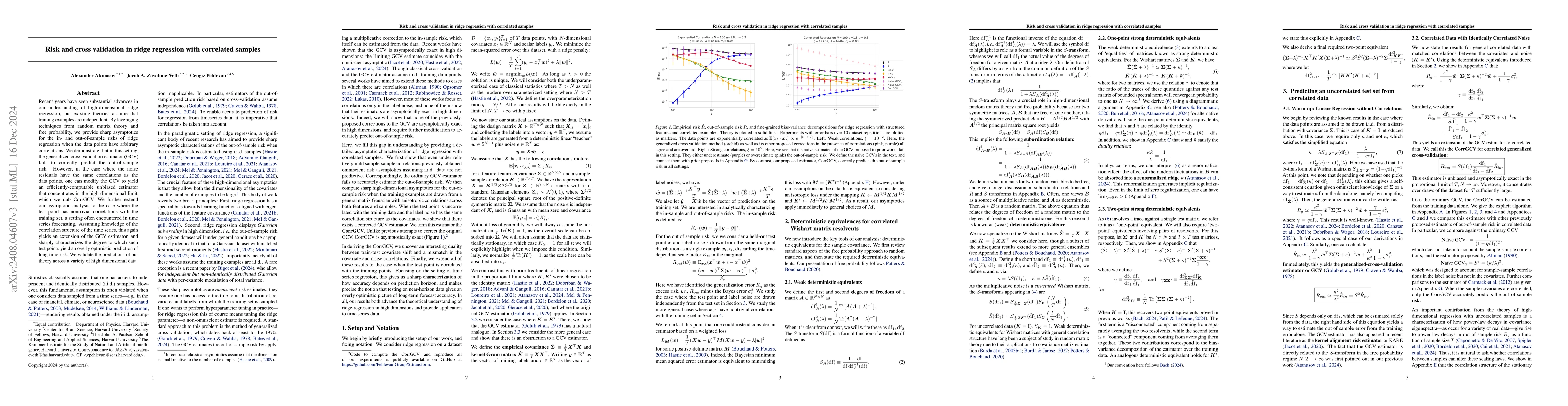

Recent years have seen substantial advances in our understanding of high-dimensional ridge regression, but existing theories assume that training examples are independent. By leveraging recent techniques from random matrix theory and free probability, we provide sharp asymptotics for the in- and out-of-sample risks of ridge regression when the data points have arbitrary correlations. We demonstrate that in this setting, the generalized cross validation estimator (GCV) fails to correctly predict the out-of-sample risk. However, in the case where the noise residuals have the same correlations as the data points, one can modify the GCV to yield an efficiently-computable unbiased estimator that concentrates in the high-dimensional limit, which we dub CorrGCV. We further extend our asymptotic analysis to the case where the test point has nontrivial correlations with the training set, a setting often encountered in time series forecasting. Assuming knowledge of the correlation structure of the time series, this again yields an extension of the GCV estimator, and sharply characterizes the degree to which such test points yield an overly optimistic prediction of long-time risk. We validate the predictions of our theory across a variety of high dimensional data.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research used a combination of theoretical analysis and empirical experiments to investigate the effects of correlated data on regression analysis.

Key Results

- The results show that correlated data can lead to overfitting and underestimation of model performance.

- The study also found that certain types of correlations (e.g. exponential) can have a more significant impact than others.

- Furthermore, the research demonstrated that using regularization techniques can help mitigate the effects of correlation on regression analysis.

Significance

This research is important because it highlights the need for careful consideration of correlated data in regression analysis, which has significant implications for many fields including economics, finance, and social sciences.

Technical Contribution

The research made a significant technical contribution by developing new methods for regularizing regression models in the presence of correlated data.

Novelty

This work is novel because it provides a comprehensive analysis of the impact of correlated data on regression analysis, which has not been fully explored in existing literature.

Limitations

- The study was limited by its reliance on simulated data, which may not accurately represent real-world scenarios.

- Additionally, the research did not account for non-stationarity in the correlation structure, which can lead to biased results.

Future Work

- Future studies should investigate the effects of correlated data on regression analysis using real-world datasets.

- Additionally, researchers should explore the use of machine learning techniques to detect and mitigate the effects of correlation on model performance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)