Summary

By specifying model free preferences towards simple nested classes of lottery pairs, we develop the dual story to stand on equal footing with that of (primal) risk apportionment. The dual story provides an intuitive interpretation, and full characterization, of dual counterparts of such concepts as prudence and temperance. The direction of preference between these nested classes of lottery pairs is equivalent to signing the successive derivatives of the probability weighting function within Yaari's (1987) dual theory. We explore implications of our results for optimal portfolio choice and show that the sign of the third derivative of the probability weighting function may be naturally linked to a self-protection problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

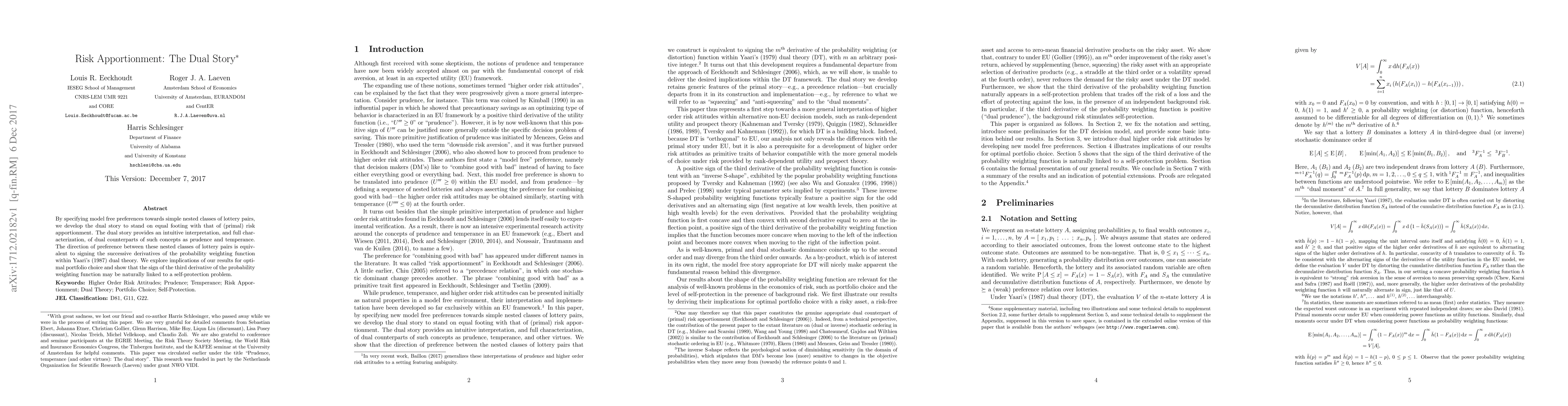

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApproval-Based Apportionment

Paul Gölz, Dominik Peters, Ulrike Schmidt-Kraepelin et al.

Apportionment with Weighted Seats

Ulle Endriss, Julian Chingoma, Ronald de Haan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)