Summary

We consider two market designs for a network of prosumers, trading energy: (i) a centralized design which acts as a benchmark, and (ii) a peer-to-peer market design. High renewable energy penetration requires that the energy market design properly handles uncertainty. To that purpose, we consider risk neutral models for market designs (i), (ii), and their risk-averse interpretations in which prosumers are endowed with coherent risk measures reflecting heterogeneity in their risk attitudes. We characterize analytically risk-neutral and risk-averse equilibrium in terms of existence and uniqueness , relying on Generalized Nash Equilibrium and Variational Equilibrium as solution concepts. To hedge their risk towards uncertainty and complete the market, prosumers can trade financial contracts. We provide closed form characterisations of the risk-adjusted probabilities under different market regimes and a distributed algorithm for risk trading mechanism relying on the Generalized potential game structure of the problem. The impact of risk heterogeneity and financial contracts on the prosumers' expected costs are analysed numerically in a three node network and the IEEE 14-bus network.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

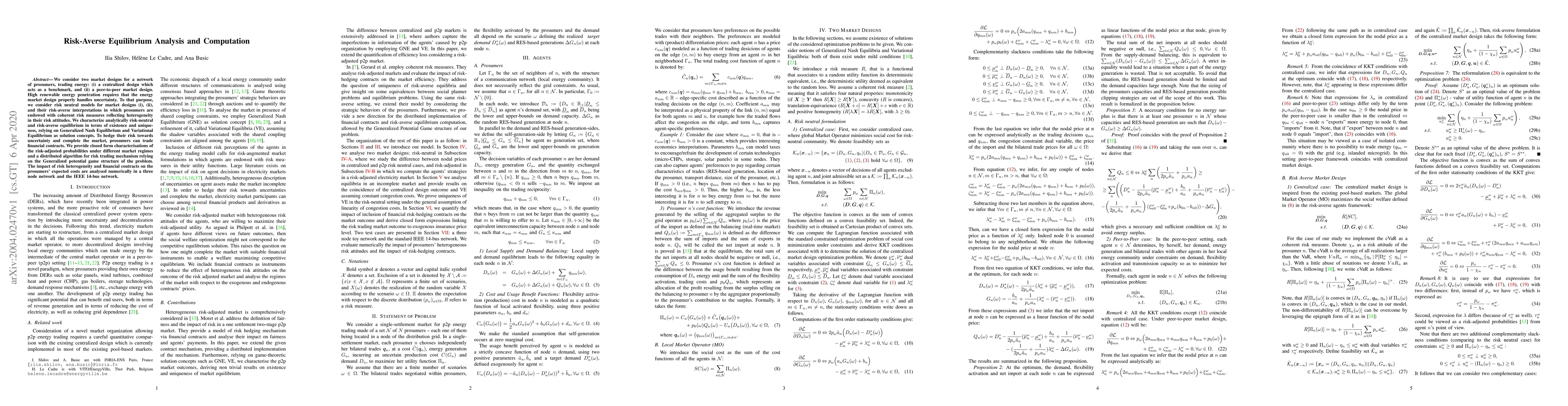

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)