Summary

In real-world scenarios, the impacts of decisions may not manifest immediately. Taking these delays into account facilitates accurate assessment and management of risk in real-world environments, thereby ensuring the efficacy of strategies. In this paper, we investigate risk-averse learning using Conditional Value at Risk (CVaR) as risk measure, while incorporating delayed feedback with unknown but bounded delays. We develop two risk-averse learning algorithms that rely on one-point and two-point zeroth-order optimization approaches, respectively. The regret achieved by the algorithms is analyzed in terms of the cumulative delay and the number of total samplings. The results suggest that the two-point risk-averse learning achieves a smaller regret bound than the one-point algorithm. Furthermore, the one-point risk-averse learning algorithm attains sublinear regret under certain delay conditions, and the two-point risk-averse learning algorithm achieves sublinear regret with minimal restrictions on the delay. We provide numerical experiments on a dynamic pricing problem to demonstrate the performance of the proposed algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

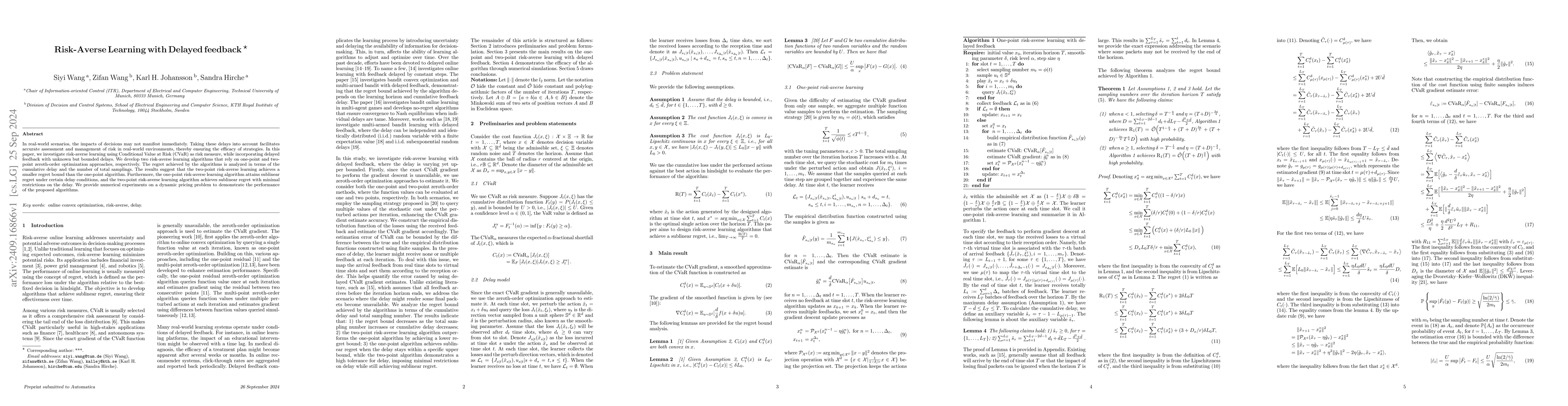

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Risk-Averse Reinforcement Learning

Mohammad Ghavamzadeh, Shie Mannor, Yinlam Chow et al.

Risk-Averse Reinforcement Learning with Itakura-Saito Loss

Evgeny Burnaev, Igor Udovichenko, Alexander Korotin et al.

No citations found for this paper.

Comments (0)