Authors

Summary

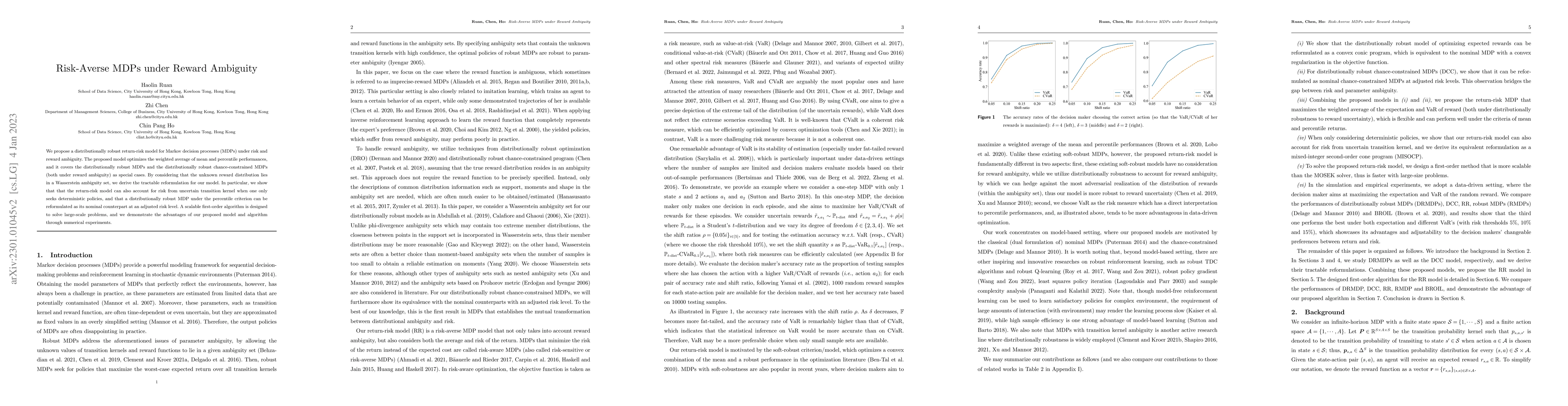

We propose a distributionally robust return-risk model for Markov decision processes (MDPs) under risk and reward ambiguity. The proposed model optimizes the weighted average of mean and percentile performances, and it covers the distributionally robust MDPs and the distributionally robust chance-constrained MDPs (both under reward ambiguity) as special cases. By considering that the unknown reward distribution lies in a Wasserstein ambiguity set, we derive the tractable reformulation for our model. In particular, we show that that the return-risk model can also account for risk from uncertain transition kernel when one only seeks deterministic policies, and that a distributionally robust MDP under the percentile criterion can be reformulated as its nominal counterpart at an adjusted risk level. A scalable first-order algorithm is designed to solve large-scale problems, and we demonstrate the advantages of our proposed model and algorithm through numerical experiments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStationary Policies are Optimal in Risk-averse Total-reward MDPs with EVaR

Xihong Su, Marek Petrik, Julien Grand-Clément

Risk-Averse Total-Reward Reinforcement Learning

Xihong Su, Marek Petrik, Jia Lin Hau et al.

RASR: Risk-Averse Soft-Robust MDPs with EVaR and Entropic Risk

Marek Petrik, Jia Lin Hau, Mohammad Ghavamzadeh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)