Summary

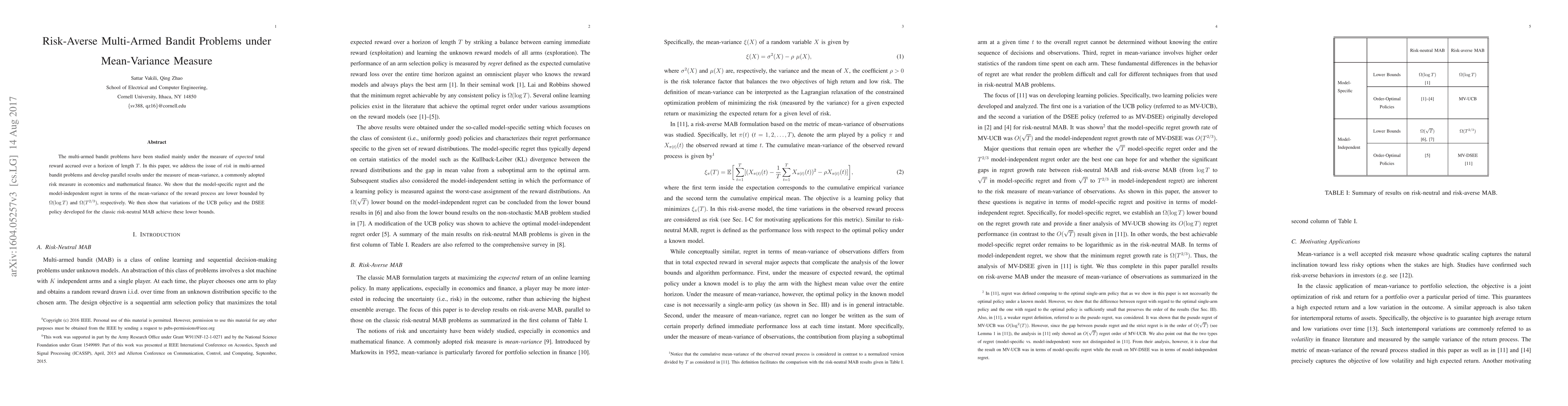

The multi-armed bandit problems have been studied mainly under the measure of expected total reward accrued over a horizon of length $T$. In this paper, we address the issue of risk in multi-armed bandit problems and develop parallel results under the measure of mean-variance, a commonly adopted risk measure in economics and mathematical finance. We show that the model-specific regret and the model-independent regret in terms of the mean-variance of the reward process are lower bounded by $\Omega(\log T)$ and $\Omega(T^{2/3})$, respectively. We then show that variations of the UCB policy and the DSEE policy developed for the classic risk-neutral MAB achieve these lower bounds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-averse Contextual Multi-armed Bandit Problem with Linear Payoffs

Yuhao Wang, Yifan Lin, Enlu Zhou

Mean-Variance Policy Iteration for Risk-Averse Reinforcement Learning

Bo Liu, Shimon Whiteson, Shangtong Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)