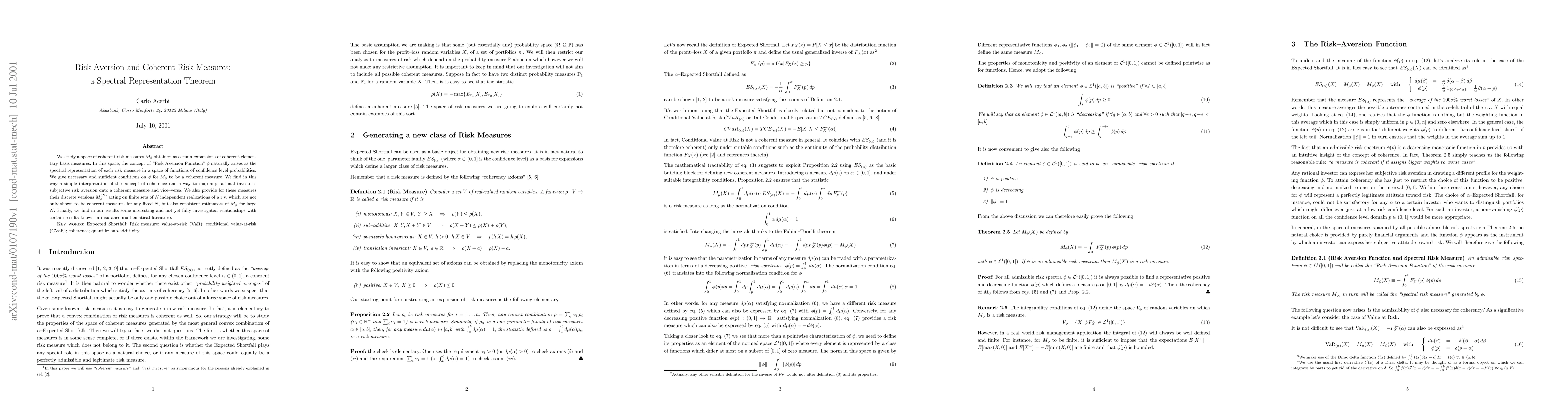

Summary

We study a space of coherent risk measures M_phi obtained as certain expansions of coherent elementary basis measures. In this space, the concept of ``Risk Aversion Function'' phi naturally arises as the spectral representation of each risk measure in a space of functions of confidence level probabilities. We give necessary and sufficient conditions on phi for M_phi to be a coherent measure. We find in this way a simple interpretation of the concept of coherence and a way to map any rational investor's subjective risk aversion onto a coherent measure and vice--versa. We also provide for these measures their discrete versions M_phi^N acting on finite sets of N independent realizations of a r.v. which are not only shown to be coherent measures for any fixed N, but also consistent estimators of M_phi for large N. Finally, we find in our results some interesting and not yet fully investigated relationships with certain results known in insurance mathematical literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersQuantifying the degree of risk aversion of spectral risk measures

E. Ruben van Beesten

Comments (0)