Summary

We present a probabilistic formulation of risk aware optimal control problems for stochastic differential equations. Risk awareness is in our framework captured by objective functions in which the risk neutral expectation is replaced by a risk function, a nonlinear functional of random variables that account for the controller's risk preferences. We state and prove a risk aware minimum principle that is a parsimonious generalization of the well-known risk neutral, stochastic Pontryagin's minimum principle. As our main results we give necessary and also sufficient conditions for optimality of control processes taking values on probability measures defined on a given action space. We show that remarkably, going from the risk neutral to the risk aware case, the minimum principle is simply modified by the introduction of one additional real-valued stochastic process that acts as a risk adjustment factor for given cost rate and terminal cost functions. This adjustment process is explicitly given as the expectation, conditional on the filtration at the given time, of an appropriately defined functional derivative of the risk function evaluated at the random total cost. For our results we rely on the Fr\'echet differentiability of the risk function, and for completeness, we prove under mild assumptions the existence of Fr\'echet derivatives of some common risk functions. We give a simple application of the results for a portfolio allocation problem and show that the risk awareness of the objective function gives rise to a risk premium term that is characterized by the risk adjustment process described above. This suggests uses of our results in e.g. pricing of risk modeled by generic risk functions in financial applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

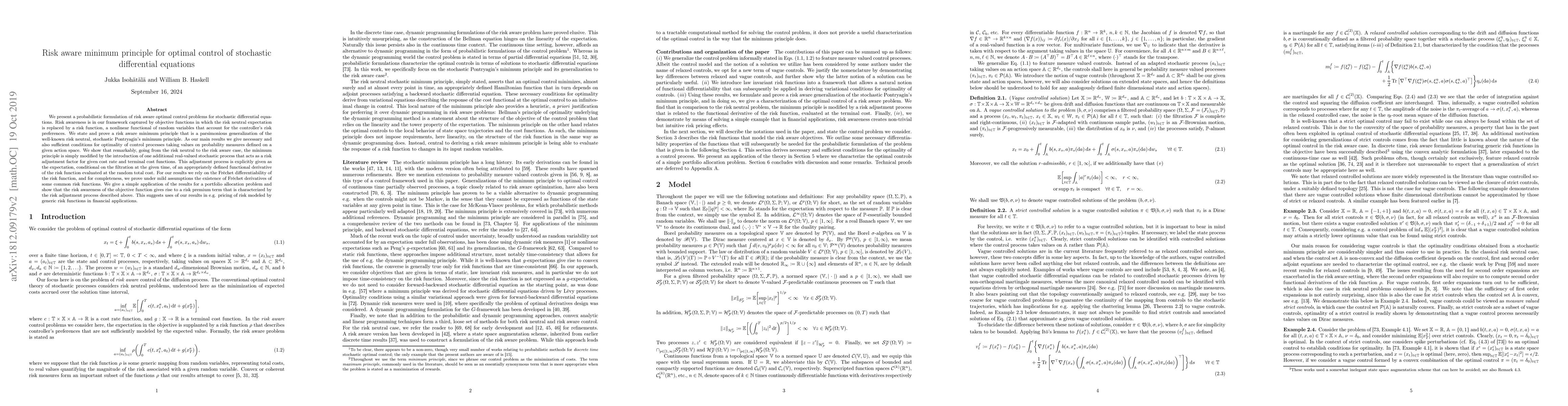

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)