Summary

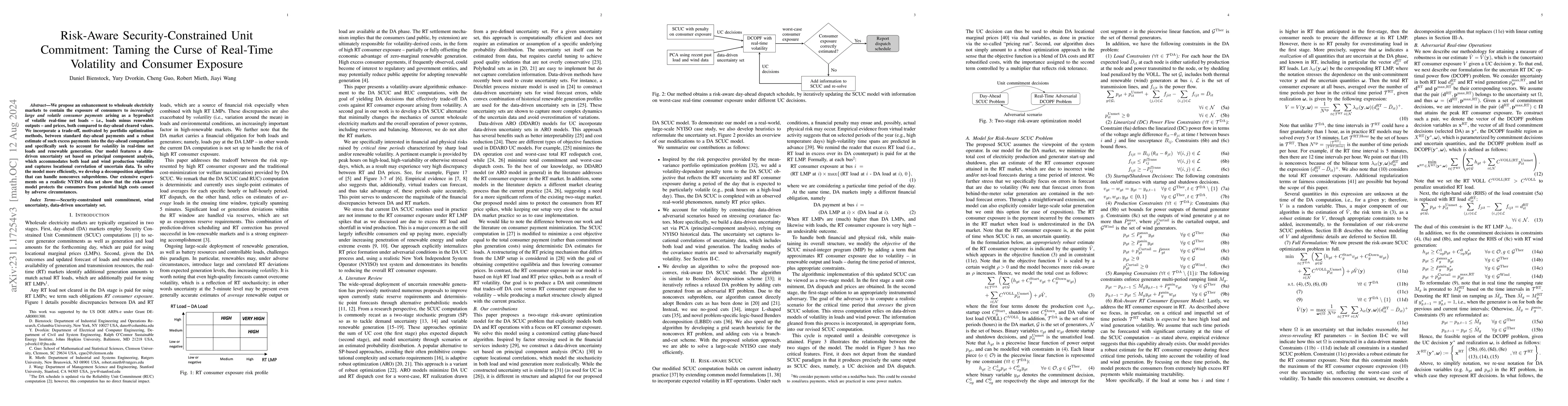

We propose an enhancement to wholesale electricity markets whereby the exposure of consumers to increasingly large and volatile consumer payments arising as a byproduct of volatile real-time net loads -- i.e., loads minus renewable outputs -- and prices, both compared to day-ahead cleared values. We incorporate a robust estimate of such excess payments into the day-ahead computation and specifically seek to account for volatility in real-time net loads and renewable generation. Our model features a data-driven uncertainty set based on principal component analysis, which accommodates both load and wind production volatility and captures locational correlation of uncertain data. To solve the model more efficiently, we develop a decomposition algorithm that can handle nonconvex subproblems. Our extensive experiments on a realistic NYISO data set show that the risk-aware model protects the consumers from potential high costs caused by adverse circumstances.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning Assisted Approach for Security-Constrained Unit Commitment

Xingpeng Li, Arun Venkatesh Ramesh

Data-Driven Continuous-Time Framework for Frequency-Constrained Unit Commitment

Mohammad Rajabdorri, Enrique Lobato, Lukas Sigrist et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)