Summary

The multi-armed bandit (MAB) problem is a ubiquitous decision-making problem that exemplifies the exploration-exploitation tradeoff. Standard formulations exclude risk in decision making. Risk notably complicates the basic reward-maximising objective, in part because there is no universally agreed definition of it. In this paper, we consider a popular risk measure in quantitative finance known as the Conditional Value at Risk (CVaR). We explore the performance of a Thompson Sampling-based algorithm CVaR-TS under this risk measure. We provide comprehensive comparisons between our regret bounds with state-of-the-art L/UCB-based algorithms in comparable settings and demonstrate their clear improvement in performance. We also include numerical simulations to empirically verify that CVaR-TS outperforms other L/UCB-based algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

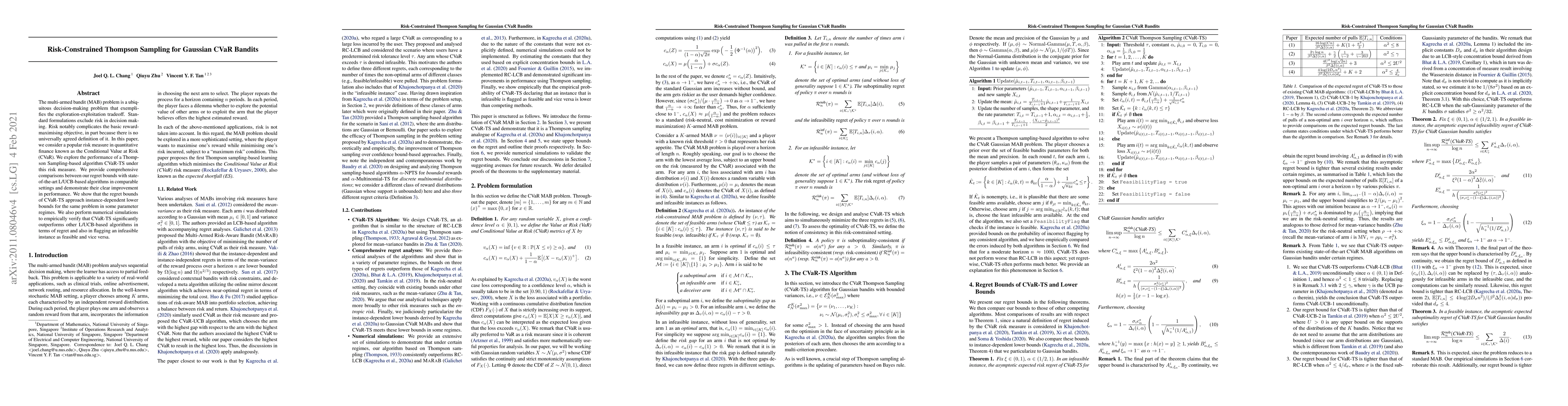

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Thompson Sampling strategies for support-aware CVaR bandits

Dorian Baudry, Emilie Kaufmann, Romain Gautron et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)