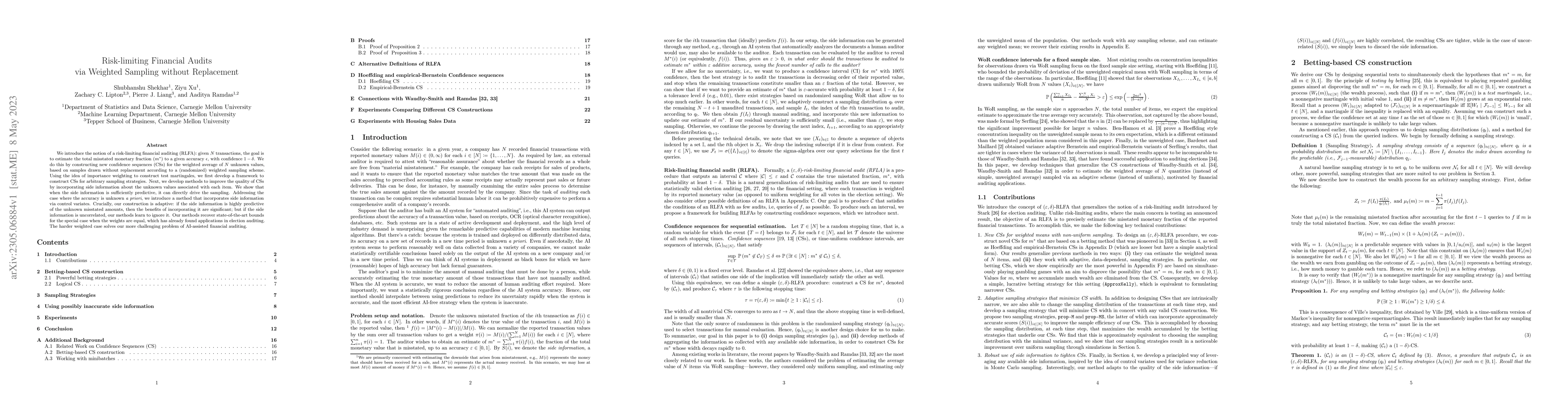

Summary

We introduce the notion of a risk-limiting financial auditing (RLFA): given $N$ transactions, the goal is to estimate the total misstated monetary fraction~($m^*$) to a given accuracy $\epsilon$, with confidence $1-\delta$. We do this by constructing new confidence sequences (CSs) for the weighted average of $N$ unknown values, based on samples drawn without replacement according to a (randomized) weighted sampling scheme. Using the idea of importance weighting to construct test martingales, we first develop a framework to construct CSs for arbitrary sampling strategies. Next, we develop methods to improve the quality of CSs by incorporating side information about the unknown values associated with each item. We show that when the side information is sufficiently predictive, it can directly drive the sampling. Addressing the case where the accuracy is unknown a priori, we introduce a method that incorporates side information via control variates. Crucially, our construction is adaptive: if the side information is highly predictive of the unknown misstated amounts, then the benefits of incorporating it are significant; but if the side information is uncorrelated, our methods learn to ignore it. Our methods recover state-of-the-art bounds for the special case when the weights are equal, which has already found applications in election auditing. The harder weighted case solves our more challenging problem of AI-assisted financial auditing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)