Summary

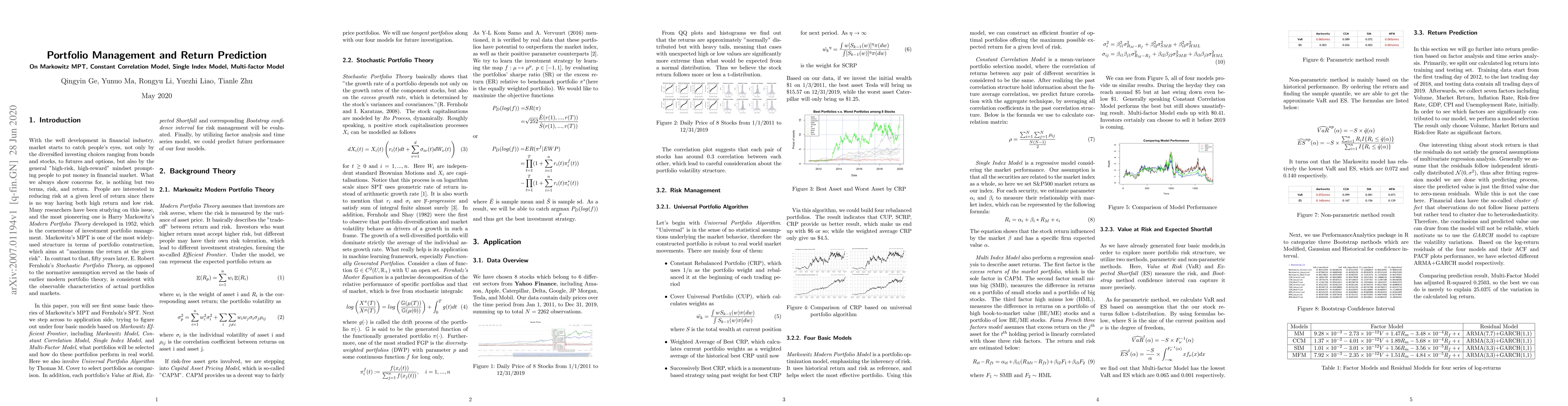

With the good development in the financial industry, the market starts to catch people's eyes, not only by the diversified investing choices ranging from bonds and stocks to futures and options but also by the general "high-risk, high-reward" mindset prompting people to put money in the financial market. People are interested in reducing risk at a given level of return since there is no way of having both high returns and low risk. Many researchers have been studying this issue, and the most pioneering one is Harry Markowitz's Modern Portfolio Theory developed in 1952, which is the cornerstone of investment portfolio management and aims at "maximum the return at the given risk". In contrast to that, fifty years later, E. Robert Fernholz's Stochastic Portfolio Theory, as opposed to the normative assumption served as the basis of earlier modern portfolio theory, is consistent with the observable characteristics of actual portfolios and markets. In this paper, after introducing some basic theories of Markowitz's MPT and Fernholz's SPT, then we step across to the application side, trying to figure out under four basic models based on Markowitz Efficient Frontier, including Markowitz Model, Constant Correlation Model, Single Index Model, and Multi-Factor Model, which portfolios will be selected and how do these portfolios perform in the real world. Here we also involve universal Portfolio Algorithmby Thomas M. Cover to select portfolios as a comparison. Besides, each portfolio value at Risk, Expected Shortfall, and corresponding bootstrap confidence interval for risk management will be evaluated. Finally, by utilizing factor analysis and time series models, we could predict the future performance of our four models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersMulti-asset return risk measures

Christian Laudagé, Felix-Benedikt Liebrich, Jörn Sass

Robust blue-green urban flood risk management optimised with a genetic algorithm for multiple rainstorm return periods

Vassilis Glenis, Chris Kilsby, Claire Walsh et al.

Comments (0)